HDFC Zip Drive Loan 2024: You have heard about many loans, some of the loans are provided by the state/central government, some loans are provided by private banks, and some are from the NBFCs. in the market, there are various kinds of loans, and each loan has its name. As for the other loan, there is one more loan in the market known as the Zip Drive Loan HDFC. majority of the people are not aware of this HDFC Zip Drive Loan. if you also want to know about the HDFC Zip Drive Loan, then here in this article we have given detailed information about the zip loan. To get this information you have to read this complete article.

Friends, you can easily get HDFC Zip Drive Loan in just a few seconds, so let’s get complete information about this important function of Zip Drive Loan. I will try my best to clear all your doubts within minutes. Now after knowing what Zip Drive Loan means, let us move ahead, but first, let me tell you that this loan is directly related to your credit score. If it is okay, then only you have the possibility of getting the loan.

What is an HDFC Zip Drive Loan?

Let us see what HDFC Zip Drive Loan is all about. Zip Drive is a type of loan that can be used to pick up a vehicle in just a few minutes. The consumer does not have to wait for the approval of the ZIP drive because it is already pre-approved. The person taking the zip drive just has to give his complete information. With Zip Drive, you can buy your favorite car on loan in just a few minutes, so it’s great, isn’t it?

How you can get a ZIP loan/Car Loan?

Now we will talk about how to get a Zip Drive Loan, friends, I have already told you in the above lines that this is a pre-approved loan. If your account is with HDFC, Axis, or any other bank, you get a Zip Drive Loan for using the account. Friends, to get a Zip Drive Loan you just have to apply through your bank’s mobile application or internet banking, complete all the information, and the loan will be approved.

SSC GD Physical Test 2024 Notice: PET/PST Dates & Requirements for Male & Female

PM Kisan: रक्षाबंधन के बाद इस दिन जारी होगी 18वीं किस्त! सम्मान निधि की राशि बजट में बढ़ेगी?

Documents you required for the HDFC Zip Drive Loan?

When you apply for a Zip Drive loan, as it is already approved by the bank, you just need to provide your ID proof and address proof. Sometimes you may also be asked for income proof, but this is only optional.

But for the safe side, you can keep some important documents with you such as:

- Aadhar card

- Pan card

- Bank statement

- A recent photograph of the applicant

- Resident proof (government approved)

HDFC ZIP drive loan Eligibility?

Till the time banks officially don’t describe the eligibility criteria for the ZIP loan. but as per the expert analysis, the bank provides the ZIP loan facilities to those consumers who have fulfilled the given criteria

• The CIBIL score of the applicant should be 750 or more

• Minimum balance should be maintained by the account holder.

• There should not be any old EMI bounced

• If you use a credit card, your payment should be on time.

• You should have an account in the bank from which you want HDFC Zip Drive Loan.

Rajasthan BSTC Pre DElEd Result 2024 LIVE: एक क्लिक से करें रिजल्ट डाउनलोड, मार्क्स, कटऑफ लिस्ट

GATE 2025 Exam Dates -1st, 2nd, 15th, and 16th February, Check Application Form & All Imp Dates

What will be the interest rate on the ZIP Drive loan?

Zip Drive Loan is a car loan with a maximum interest rate of 9% per annum. If you are a bank employee then you can get up to 7% interest on this Zip Drive loan.

| For normal consumers | 9% per annum interest rate |

| For the same bank employee | 7% per annum interest rate |

ZIP Drive loan tenure

Although the tenure of the HDFC Zip Drive loan you get is mainly from 1 to 5 years, if someone is a customer or employee of the bank, then he can get the tenure of this loan up to 7 years.

Benefit/loan amount of Zip Drive loan of HDFC

Now, if you go for a car loan, you can get up to a 90% loan for your car, but if you are offered a Zip Drive loan, you can get a 100% loan, i.e. The loan amount you get for driving a car. Under this, you can buy a car without any down payment.

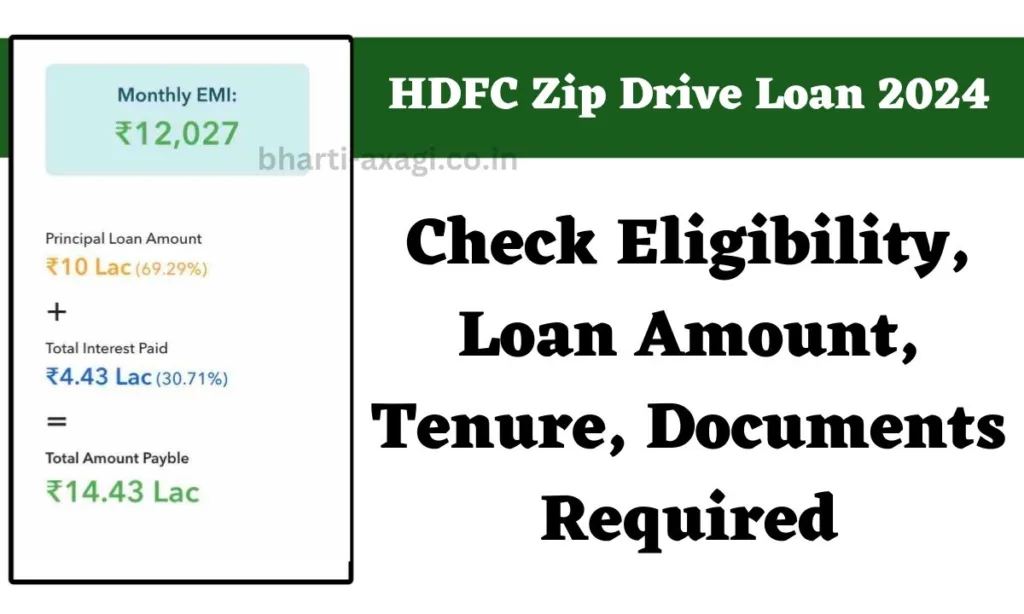

Zip Drive Loan is always pre-approved, so it is available as per your eligibility, Zip Drive Loan is for a minimum amount of Rs. Can be obtained from. 3 lakh and a maximum of Rs. 10 lakhs or sometimes even more.

How to apply for the Zip Drive HDFC Loan?

You need to open your HDFC Mobile Banking application or Internet Banking

- Tap on Zip Drive Offer

- Select loan amount and tenure

- Fill in the information and verify through OTP,

- And that’s it, your loan gets approved and the DO letter is received by the person from whom you are buying the car.

- Now your monthly instalment is deducted from your account on the due date.