Capital One Data Breach Settlement 2025: In July 2019, Capital One, one of the largest banks in the United States, made headlines for all the wrong reasons. A massive data breach exposed the personal information of over 100 million customers, shaking the financial industry and raising serious concerns about cybersecurity and corporate accountability. Fast forward to 2023, and the fallout from the breach has led to a landmark settlement that could reshape how companies handle data protection and how regulators enforce cybersecurity standards.

If you’re wondering what the Capital One data breach settlement means for you, how it happened, and what lessons we can learn from it, you’re in the right place. This article dives deep into the details of the breach, the legal and regulatory consequences, and the steps you can take to protect yourself in an increasingly digital world.

What Was the Capital One Data Breach?

The Capital One data breach was one of the largest financial data breaches in U.S. history. It occurred when a hacker exploited a misconfigured web application firewall, gaining access to the bank’s cloud storage systems. The attacker, a former Amazon Web Services (AWS) employee, stole sensitive data from approximately 100 million customers in the U.S. and 6 million in Canada.

What Information Was Stolen?

The stolen data included:

- Names

- Addresses

- Phone numbers

- Email addresses

- Dates of birth

- Social Security numbers

- Credit scores

- Payment histories

- Bank account details

While no credit card numbers or login credentials were compromised, the sheer volume of sensitive information exposed left millions of customers vulnerable to identity theft, phishing scams, and financial fraud.

How Did the Capital One Data Breach Happen?

The breach was the result of a combination of human error and inadequate cybersecurity measures. Here’s a breakdown of what went wrong:

- Misconfigured Firewall: Capital One’s web application firewall was improperly configured, creating a vulnerability that the hacker exploited.

- Cloud Storage Access: The hacker accessed data stored on Amazon Web Services (AWS), Capital One’s cloud service provider.

- Delayed Detection: The breach went undetected for several months, allowing the hacker to extract vast amounts of data.

The incident highlighted the risks of relying on third-party cloud services without proper security controls in place. It also raised questions about Capital One’s ability to protect its customers’ data.

$697 Direct Deposit: Check Eligibility, Payment Dates, and How to Claim

Bharti AXA Life Insurance 2025: Check Policy Status, Premium, Benefits and Download Policy

The Legal and Regulatory Fallout

The Capital One data breach triggered a wave of legal and regulatory actions. Here’s what happened:

Capital One Data Breach Settlement

In the aftermath of the breach, Capital One faced multiple class-action lawsuits from affected customers. The plaintiffs argued that the bank had failed to implement adequate security measures, putting their personal information at risk.

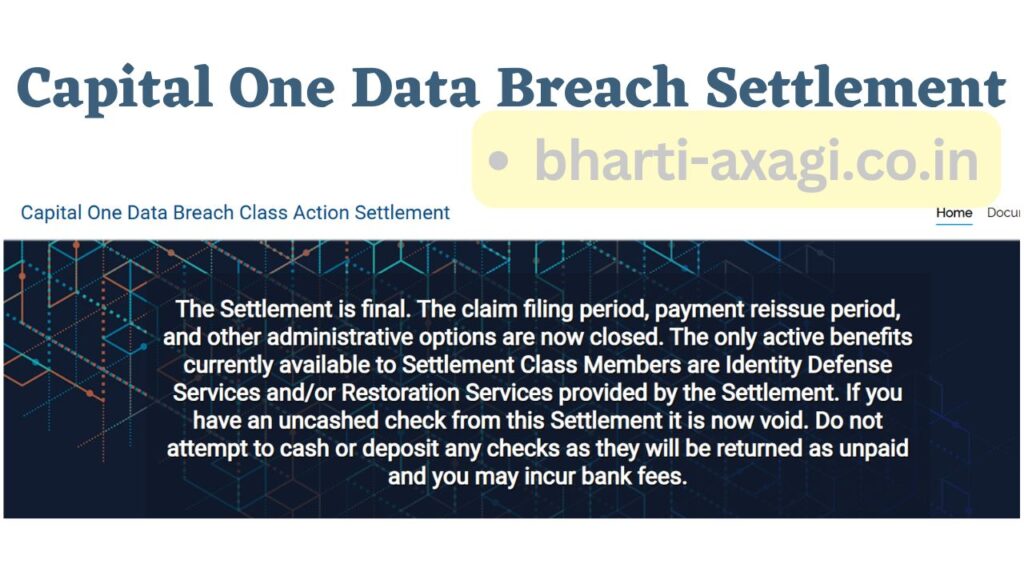

In 2021, Capital One agreed to a $190 million settlement to resolve these lawsuits. The settlement included:

- $80 million in restitution for affected customers.

- $110 million to cover legal fees and other costs.

While the settlement provided some relief to customers, many felt it didn’t go far enough in holding Capital One accountable.

Regulatory Penalties

In 2023, Capital One reached a separate settlement with U.S. regulators, including the Office of the Comptroller of the Currency (OCC) and the Consumer Financial Protection Bureau (CFPB). The bank agreed to pay an additional $80 million in fines for failing to establish effective risk management protocols and safeguard customer data.

The settlement also required Capital One to:

- Enhance its cybersecurity infrastructure.

- Conduct regular audits and vulnerability assessments.

- Provide ongoing employee training on data protection.

These mandates reflect a growing emphasis on proactive risk management in the financial industry.

What Does the Capital One Data Breach Settlement Mean for Consumers?

If you were affected by the Capital One data breach, you might be wondering what the settlement means for you. Here’s what you need to know:

Compensation for Affected Customers

As part of the 190 Million class−action settlement, eligible customers could claim upto 190 million class−action settlement, eligible customers could claim up to 25,000 for documented losses resulting from the breach. This included expenses related to identity theft, fraud, and credit monitoring.

Free Credit Monitoring

Capital One also offered free credit monitoring and identity protection services to affected customers. These services help detect suspicious activity and provide an added layer of security.

What You Should Do Now

Even if you weren’t directly affected by the breach, the incident serves as a reminder to take proactive steps to protect your personal information. Here are some tips:

- Monitor Your Credit Report: Regularly check your credit report for unauthorized activity. You can get a free report annually from AnnualCreditReport.com.

- Enable Two-Factor Authentication: Add an extra layer of security to your online accounts.

- Use Strong Passwords: Create unique, complex passwords for each account and consider using a password manager.

- Beware of Phishing Scams: Be cautious of emails or calls requesting personal information.

- Consider Identity Theft Protection: Services like LifeLock or Identity Force can help monitor your information and alert you to potential threats.

Lessons Learned from the Capital One Data Breach

The Capital One data breach offers valuable lessons for both companies and consumers. Here’s what we can learn:

For Companies

- Invest in Cybersecurity: Companies must prioritize cybersecurity and allocate sufficient resources to protect customer data.

- Regular Audits and Testing: Conduct regular vulnerability assessments and penetration testing to identify and address weaknesses.

- Third-Party Risk Management: Ensure that third-party vendors and cloud service providers adhere to strict security standards.

- Transparency and Accountability: Be transparent with customers about data breaches and take responsibility for securing their information.

For Consumers

- Stay Informed: Keep up with news about data breaches and take action if your information is compromised.

- Protect Your Data: Use strong passwords, enable two-factor authentication, and avoid sharing sensitive information online.

- Monitor Your Accounts: Regularly check your bank and credit card statements for unauthorized transactions.

- Know Your Rights: Familiarize yourself with data protection laws and your rights as a consumer.

Impact on the Financial Industry

The Capital One data breach has had a ripple effect across the financial industry, prompting changes in how companies approach cybersecurity and data protection. Here’s how:

- Increased Regulatory Scrutiny: Regulators are now more vigilant about enforcing cybersecurity standards and holding companies accountable for data breaches.

- Higher Stakes for Non-Compliance: The financial penalties and reputational damage associated with data breaches are higher than ever.

- Shift to Proactive Risk Management: Companies are moving away from reactive measures and focusing on proactive risk management to prevent breaches.

- Greater Consumer Awareness: Consumers are becoming more aware of the importance of data protection and are demanding greater transparency from companies.

How to Protect Yourself in the Digital Age

In today’s digital world, data breaches are unfortunately becoming more common. Here are some additional steps you can take to protect yourself:

- Freeze Your Credit: A credit freeze restricts access to your credit report, making it harder for identity thieves to open accounts in your name.

- Use a VPN: A virtual private network (VPN) encrypts your internet connection, protecting your data from hackers.

- Update Your Software: Keep your devices and software up to date to protect against vulnerabilities.

- Be Cautious Online: Avoid clicking on suspicious links or downloading attachments from unknown sources.

Conclusion: Capital One data breach settlement

The Capital One data breach settlement is a landmark case that underscores the importance of cybersecurity and corporate accountability. For companies, it’s a reminder that protecting customer data is not just a legal obligation but a moral one. For consumers, it’s a wake-up call to take control of their personal information and stay vigilant in an increasingly digital world.

As cyber threats continue to evolve, the lessons from the Capital One breach will shape how we approach data protection in the future. Whether you’re a business owner, a consumer, or simply someone who values their privacy, now is the time to take cybersecurity seriously.

By staying informed, taking proactive steps, and holding companies accountable, we can create a safer digital environment for everyone. If you were affected by the Capital One breach, make sure to take advantage of the resources and protections available to you. And if you weren’t, let this be a reminder that in the digital age, cybersecurity is everyone’s responsibility.