Americans will receive upto $5108 Payment: Payouts are something, the Americans are waiting for. These stimulus checks provide financial assistance to the Americans up to a payout of $5,108 each month. There are certain criteria that the individuals have to meet like they must earn the maximum taxable wage for 35 years and wait until they are 70 to start receiving benefits. In this article you are going to explore who is eligible, the application process, how can you maximize your benefits and can turn this into a larger retirement income.

It provides official information and practical tips to help you maximize your Social Security payments. If you are going nearer to the retirement and you are confused that when you can file for Social Security, then this article will help you understand the requirements and how to ensure you get the most from your benefits.

$5108 Payment 2025

As we all know that SSA is providing retirement benefits along with Survivor benefits and disability benefits to several citizens of U.S around 70 million Americans. This stimulus checks are issued monthly and almost all recipients receive their funds in a single payment. And remember that retirement benefits are given to the individuals monthly basis according to their birth date and duration of their payment history. SSI payments support the senior citizens, blind people and disabled individuals having limited income. It is usually disbursed at the start of each month.

Those SSI recipients or claimants who have been receiving Social Security benefits since before May 1997 will receive their payments. The claimants will get the amount credited in their bank accounts on Thursday, May 1, while Social Security payments will be given on May 2.

Americans will receive upto $5108 Payment: Key Highlights

| Payment Of Up To $5,108 | |

| Particulars | Details |

| Maximum Payout amount | $5,108 |

| on an average the individuals are able to get | $1,976 (as per SSA) |

| Eligibility Requirement | Individuals with 35 plus years of maximum earnings or work history who delay retirement until age 70 |

| maximum taxable income | $176,100 |

| when you can start applying for the benefit? | early retirement age i.e. 62 |

| at which age you can maximizeyourbenefit | Fully Retirement Age i.e. 70 |

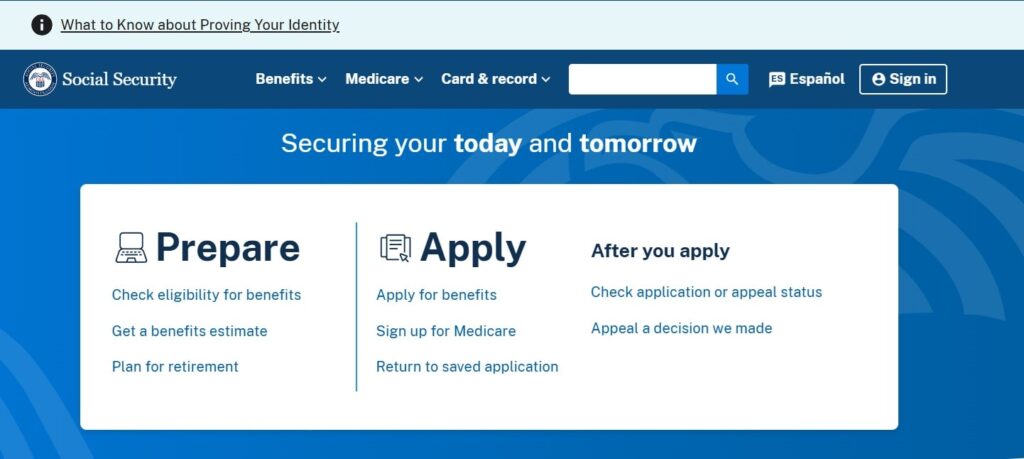

| Application Website | SSA Official Website |

| How can you proceed for claim? | Use the My Social Security Account |

SNAP Payments in May 2025 for Texan Residents: Find out when and how much it will cost?

Social Security April 2025 Payment Out Today – Check How Much Will You Receive?

It is just a prediction that in 2025, some Americans may be eligible for a Social Security payment of up to $5108 Payment which raises an important question for those approaching retirement. The questions one applicant can face about When is the best time to file for Social Security to maximize benefits? If you are approaching for retirement, then this is the right time to explore or know that what options you have left with and how could you plan your $5108 Payment retirement benefits.

To qualify for this $5108 Payment per month the applicants must have to meet certain criteria.

Eligibility Criteria for $5108 Payment

- Before applying for the claim just check that you are eligible enough to get the $5108 Payment or not.

- So those individuals who are going to get SSBs they just need to work for at least 35 years.

- SSA will calculate your payout by evaluating your 35 years of earnings. So basically the main determining factor is your working history.

- There is a condition that if you have worked less than that then they will fill in the missing years with zeros, which can reduce your overall benefit.

- There are some oncome thresholds to be followed.

- Income threshold for qualifying to get the payout is $176,100 and this is also decided by the SSA.

- The income capacity is changing like it was changing Over the years like in 2000, the income limit was $76,200, and $106,800 in 2010 and $137,700 in 2020.

- Also remember that while you can start receiving Social Security at age 62 and this is the wise decision which can cost you the reduction of up to 30%.

- One can get the full $5108 Payment benefit up to maximum if they will wait until their Full Retirement Age which is 67 for most individuals born after 1960.

If you want to achieve a monthly benefit of $5,108 then you just need to avoid taking the benefits until you are at your age 70, which will give you an 8% increase for each year you delay past your FRA which will cost you a total increase of 24% if you wait the full three years.

How can you maximize your tax benefits?

- The methods of calculating the social security benefit is depend up on several factors. So now the question is how individuals can maximize the benefit.

- At first the claimants must have a minimum of 35 years of employment history with earnings that are subject to Social Security taxes.

- Then to show the eligibility the individuals have to earn at least $176,100 annually in jobs covered by Social Security.

- Even if you are taking early retirement then you have to wait until you reach the age of 70 to claim your $5108 Payment.

- In this way you can maximize your monthly benefits by delaying the retirement credits.

- To get the claim open a ‘My Social Security’ account which will provide access to your earnings history, and also it will give you the benefits along with you can apply online.

- You can start applying to get the claim after reaching up to your retirement age that is 70; you just have to submit your benefits application through the SSA’s online portal.

Capital One Data Breach Settlement 2025: Know the Claims Process & Recent Updates

£5285 PIP Payment for UK Seniors: Check Payment Date , Eligibility and New Updates

The $5,108 $5108 Payment benefit is not that easy to get. Most of the individuals have not earned maximum taxable income for 35 years and many of them start claiming benefits before age 70 which lowers their payments. The normal payout what the claimants receive is $1,976 and even those with basic earnings who claim at 67 might only get around $3,800 to $4,000 monthly. The applicants can increase their monthly benefits by increasing their working hours. They can wait for their 70’s to claim the benefit.