Shriram Finance Personal Loan Apply Online 2025: If you need instant personal loan for financial expenditure then you can apply for personal loan in Shriram Finance Company where you can get instant loan within few minutes. Most of the companies are asking salary proof or other income Proof From the loan applicant, but if you do not have a regular source of income or self employed then you can apply in Shriram Finance personal loan without income proof.

The bank is offering up to 10 lakh personal loan through online mode. So if you are also searching for best personal loan scheme then you can read it is article where you will get exact information about Shri Ram Finance personal loan 2025 including the application procedure, eligibility criteria, documentation, Shriram personal loan interest rate 2025, processing fees and other charges.

Shriram Finance Personal Loan Apply Online 2025

If you’re considering a personal loan from Shriram Finance, you’re in luck! They offer loans for various needs like weddings, home renovations, education, medical expenses, vacations, and more. The best part? For loans up to 1 lakh rupees, you don’t need any collateral when you apply online. Interest rates start from just 12% per year, but they may vary based on your credit score and individual circumstances. Before you apply, it’s crucial to check the Shriram Finance personal loan eligibility criteria and understand all the terms and conditions. You can find all the necessary information on Shriram Finance’s official website. So, take a quick visit to their site before you apply to make sure you’re fully informed.

Shriram Personal Loan Interest Rate 2025

Certainly! When obtaining a personal loan from Shriram Finance, borrowers can select a repayment period of up to 60 months. Interest rates commence at 12% annually but may escalate to a maximum of 42%. A processing fee, up to 3% of the loan amount, applies based on the applicant’s eligibility. Additionally, GST is deducted from the disbursed loan amount. It’s imperative to note that individuals with lower credit scores may incur higher interest rates. Therefore, prudent borrowing practices are advised to mitigate adverse effects on one’s credit score.

Shriram Finance Personal Loan Eligibility

To apply for a Shriram Finance instant personal loan, there are a few key eligibility criteria you need to meet:

● Citizenship: You must be a citizen of India to apply for the loan.

● Age: You should be at least 21 years old and not more than 60 years old to be eligible.

● Income: It’s essential to have a steady source of income to qualify for the loan.

● Credit Score: Your CIBIL score, which reflects your creditworthiness, should be in good standing.

Meeting these requirements will make it easier for you to secure a personal loan from Shriram Finance.

Documents for Shriram Finance Instant Personal Loan

When you apply for a Shriram Finance unsecured loan 2025, you’ll need to provide the following documents:

● Identity Proof: You can upload your Aadhar card, PAN card, passport, or Voter ID card to verify your identity.

● Address Proof: Supporting documents like your passport, driving license, or gas connection bill can be uploaded to confirm your address.

● Recent Passport Size Photograph: A clear, recent photo of yourself is required for identification purposes.

● Income Proof: You’ll need to submit a document that shows your income for the past three months.

● Bank Statement: Provide your bank statement for the last six months to demonstrate your financial history.

● Cancelled Cheque: This is required for Electronic Clearing Mandate. Simply submit a cancelled cheque with your account details.

Having these documents ready will streamline the online application process for your Shriram Finance personal loan.

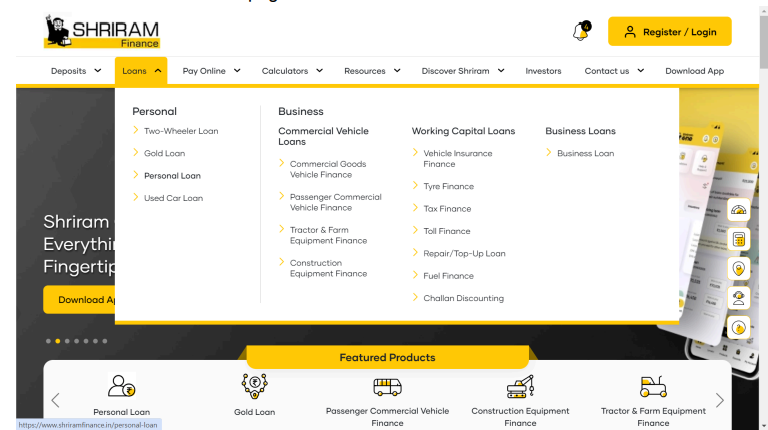

How To Apply For Shriram Loan?

To apply for a Shriram Finance personal loan and potentially receive up to 15 lakh rupees instantly in your bank account, follow these simple steps:

● Visit the official website of Shriram Finance: [https://www.shriramfinance.in/.

● Once on the website, navigate to the “Loan” section. You may find this in the main

menu or on the homepage.

● Within the loan section, select “Personal Loan.”

● After clicking on the “Apply Now” button, you’ll be prompted to enter your mobile number, name, and pin code. Once you’ve filled in this information, proceed by clicking on the “Apply Now” button.

● Next, you’ll be directed to an online application form where you’ll need to provide your personal details such as your name, date of birth, banking details, employment

information, and contact details.

● Once you’ve completed filling out the form, you’ll need to upload all the required documents in scanned form. This includes your identity proof, address proof, recent

passport size photograph, income proof document, 6 months bank statement, and cancelled cheque for Electronic Clearing Mandate.

● After submitting all the necessary documents and information, click on the “Submit” button. Shriram Finance will then verify your application based on the provided details. If any deficiencies are found, they will contact you to rectify them.

Once your application is approved, Shriram Finance will transfer the personal loan amount directly to your bank account through online mode within a few hours of your application.