Bad CIBIL Score Personal Loan Apply: Bad credit score is very challenging situation for the borrowers while getting the loan from banks and financial companies. However the maximum credit score is 900 but most of the banks are providing loan with 750 or more credit score business considered as a good credit score. But if you are facing a low credit score condition and facing difficulties to get a Personal Loan for Low CIBIL Score then you can check tips in this article. We are providing you tips to Get Loan with Bad Credit in India or credit score and will also share with you tips to increase your CIBIL score accordingly.

The credit score is also known as CIBIL score in India which is managed by the Credit information bureau India Limited. The range of the CIBIL score is between 300 to 900 and is considered by the financial companies while providing the loan to their customers. How much you have a good CIBIL score or increased credit score, you will get good loan offers with minimum interest rates from different banks and financial companies. But if you are unable to maintain your credit score and it is reduced with less than 650, then you may face delay of the loan approval of Instant Loan for CIBIL Score Below 600, rejection of the loan application, higher interest rates loan etc.

Bad CIBIL Score Personal Loan Apply in 2025

Personal loans are listed under the unsecured loan schemes. Because the Lander do not have any Collateral or guarantee to collect loan amount from their customers. So they are following credit score based loan approval programs across the country. The credit score demonstrates trustworthiness of the applicant and will give surety to the landers or Bank against the loan amount. If you are using more than the credit limits or not paying the bills on time, do not engage in financial activities etc then your credit score may reduce and will not help you to get a good personal loan.

Get Loan with Bad Credit in India

There are many activities which reduce your credit score. We are listing the few reasons for reducing the CIBIL score which are followed by most of the customers and getting difficulties.

- Multiple credit score applications: Whenever you apply for personal loan, the bank automatically send a request to the Credit information bureau India Limited, To check the credit score of the applicant, But if you are applying for personal loan in more than 2 to 3 Banks at one time or in a short duration then it will indicate that you are taking a huge loan amount from different banks and will automatically reduce your CIBIL score. So before applying for the loan, you should check and compare loan offers from different companies and banks and after that should apply in only one bank according to your condition.

- Use maximum credits: Banks provide different credits to their customers according to their plan which can be used by the individual in case of emergency. However it is suggested to all the customers do not use more than 30% credit limits and return the credit amount within a time duration. However if you use maximum credits limits and delay to return the payment, then it will reflect on your credit score.

- Return the previous loan: If you are already a borrower from any other bank and applying for a new loan then it will also reply on your CIBIL score and it will automatically reduce. So if you are engaged in any loan scheme then you should complete it first and after that apply for the next loan amount. However if you want to get urgent loan then can use the top up loan facility on your existing loan scheme so the bank will increase loan amount on your application and it will not negatively reflect on your credit score.

Apply for Bad CIBIL Score Personal Loan 2025?

If you are looking for a personal loan with bad credit score then you can follow the following steps to apply it accordingly:

- Compare the loan amount: Firstly you need to search personal loan features of different bank and small financial companies and compare their facilities so you can opt the good loan scheme according to your condition.

- Now you need to login on the dashboard of the website of the company and click on the personal loan link

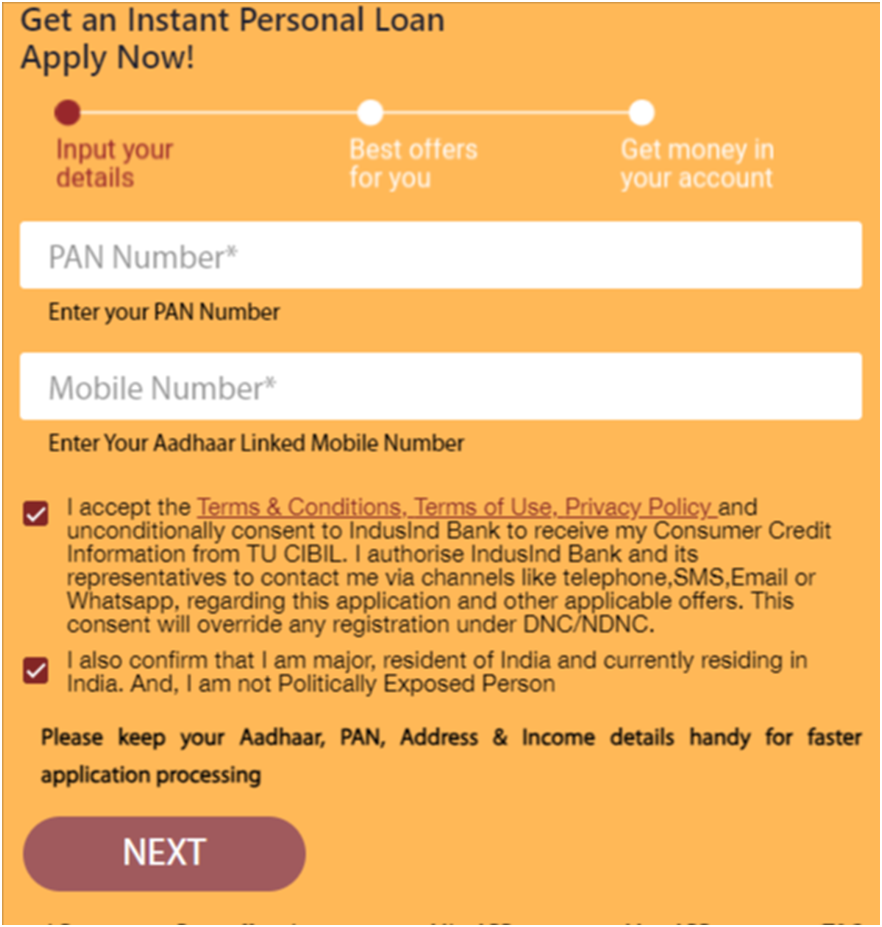

- After that provide your PAN Card information and mobile number details in the application form and click on the continue or next link

- So you will reach on the new page where you need to provide your basic information, bank account details, salary information, and other details

- Now select the loan amount according to the offer provide by the company and prepare the EMI according to your eligibility.

- After that you will be asked to complete the KYC by providing Aadhar card, pan, passbook, mobile number and other details and upload their documents accordingly

After that Bank will evaluate your eligibility and will release the loan amount in your bank account directly after providing approval.

Eligibility for personal loan with bad credit score

- If you are Indian citizen and more than 18 years old then can apply for the Personal loan for low credit score in any bank

- If you are applying for bad CIBIL score personal loan, then should have at least 15000 rupees to 18000 per month salary from last 6 month.

- You need to use the bank account which is linked with your Aadhar Card and PAN card.

Loan providers for bad credit in 2025

If you are looking for a bad credit score loan offer then should consider that, company will not provide you a good loan amount with a bad credit score. Instead of this you may also be charged higher interest rates on the loan amount which may be up to 36% maximum according to your condition. At the initial time, you will get reduced loan amount, and it is a good approach to apply for a minimum loan amount from the bank, so you should repay in the loan amount without any delay and bank will automatically increase your credit score. However you can also search small financial companies to receive the loan offer for your bad credit score as these companies are providing flexibility on the loan amount and the application procedure and you can submit the application by using their mobile application also.