Canada Extra GST Payment 2025: Canada revenue agency is releasing the Canada GST credits payment 2025 for the second quarter in October month. Candidates who are living in Canada and want to claim the payment of GST credits can read this article where we will share with you the updated information of extra GST credit payment 2025 including the procedure to claim the payment, Eligibility criteria, officer statement on releasing extra GST payment, date of releasing the payment etc.

Canada GST Payment 2025

The Canada GST (Goods and Services Tax) credit is a tax-free payment made to individuals and families to help offset the cost of the GST on goods and services. It’s a quarterly payment made by the Canada Revenue Agency (CRA) to eligible recipients.

The credit is designed to help low- and middle-income individuals and families, as well as those with children, to reduce the impact of the GST on their household budgets. The payment amount varies depending on income level, family size, and other factors, and is typically paid in January, April, July, and October of each year. The GST credit is intended to make the tax system more fair and equitable, by providing a refundable credit to those who need it most.

Extra GST Payment in October 2025

Currently the Government of Canada is providing approximately 519 CAD credits on GST is quarter to each individual applicant. But the married couples in the country can claim the maximum payment of 680 CAD from Canada revenue agency.

However it is the approximately payment which may go up or down according to different criterias and conditions including earning of individual. Apart from this candidates who are living with their children whose age in less than 18 years, can additionally claim 179 CAD payment accordingly and it will increase according to the number of children in the family.

However the payment is released by the Canada revenue agency to overcome the burden of high tax rates in the Canada, but it is not sufficient to fulfill individuals needs. There are many financial institutions and reports which are continuously requesting from the Government and financial department in the country to increase the credits of GST for the beneficiaries, but there are no official notification released by the Canada revenue agency for increasing the payment.

$697 Direct Deposit in June 2025 – Check Eligibility and Payment Date

But we are getting news from citizens in Canada about increment of monthly payment managed by CRA including CPP payment, child benefit payment etc, so beneficiaries may expect to receive increased payment in the second quarter payment in October of 2025.

Eligibility Criteria For Canada Extra GST Payment 2025

Citizens in Canada can check the latest eligibility criteria of getting the GST credit payment 2025 in this section after that they can apply accordingly:

- Only citizens of Canada are eligible to claim the GST credit payment into four quarters.

- The minimum age of the individual should be at least 19 years old while applying for the GST credit. However it they are living with their parents or their guardians or living with their common spouse then then also apply for the scheme.

- This relief is only designed for tax payer in the country so you must pay the annual tax of 2023 to claim the GST credit payment.

- If you are applying as an individual beneficiary then your income should be less than 49166 CAD .

- If you are living with your common spouse then your annual income should be less than 53070 CAD

- Apart from this if you have children then you can apply with the maximum extra payment of 6396 CAD for each child.

$1200 Support Payment Singapore 2025: Who Is Getting? Eligibility, Dates & Disbursement Schedule

Procedure To Claim The Payment 2025

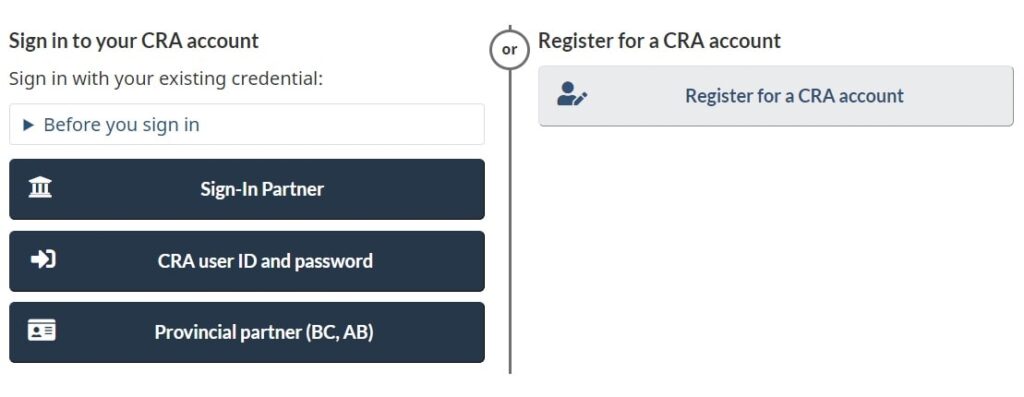

If you have sufficient eligibility criteria and want to claim the GST credit then you can read the following step by step procedure to apply online:

- Firstly visit to the official website of Canada revenue agency. This is the direct link of the website https://www.canada.ca/en/

- After that you will reach on the new page where you have to believe on the sign in to my CRA.

- Now you will be ask to select login type according to your category and use the user id and password to login on the portal

- Now you can see various services available on your dashboard where you have to select the link of GST credit payment

- After that provide your tax information along with your personal details

- Now submit the related documents to the website

After that you have to re-check all the information and submit the application form. So authority will verify your all the details and will provide the GST credit payment according to your category and condition.

FAQs: Canada Extra GST Payment 2025

In 2025, will Canada receive an additional GST payment?

The Canada Revenue Agency has confirmed that these payments will be released at the beginning of 2025.

Does Canada require an additional GST payment?

In 2025, eligible Canadians will receive additional GST payments.