CRA Benefits Payment date for March 2025: After pandemic people are facing severe financial problems as there is inflation and influence of severe cost escalation going on. To cop up with the current environment Canadians are in need of financial assistance through various government initiatives. Here we can discuss about various upcoming programs going to be happen in March such as the Canada Child Benefit or CCB, Canada Pension Plan or CPP, Old Age Security or OAS and Ontario Disability Support Program or ODSP.

These programs are important financial assistance which can provide essential financial resources for millions of Canadians annually. As March is ongoing people of Canada are waiting for several benefits through which they could have been secure their monthly payments timely. These initiatives are given by the govt. of Canada to assist various groups of people from various areas within the population, including families with children, seniors and individuals with disabilities. Through this article you will gain a clear understanding about the benefits for which you may qualify and the process to access them can greatly enhance your financial stability.

CRA Benefits Payment date for March 2025

There are several benefits coming to give happiness to Canadians. These are:

| Various Schemes | Payment Date |

| Canada Child Benefit /CCB | March 20, 2025 |

| Canada Pension Plan/CPP | March 27, 2025 |

| Old Age Security /OAS | March 27, 2025 |

| Ontario Trillium Benefit | March 10,2025 |

| Veteran Disability Pension | March 28,2025 |

Indian Post GDS 2025 1st Merit List PDF: Check Release date, Cut-Off Marks & Steps to Download

FCI Recruitment 2025 Apply Online: 33566+Posts, Notification, Eligibility, Age Limit

1. Canada Child Benefit (CCB):

CRA provides CCB as it is a tax free monthly benefit and provided to the eligible individual or families only. This benefit gives assistance to the families with expenses related to raising children under 18. From the day it has begun this program has played a key role in lowering child poverty in Canada. The Canada Revenue Agency (CRA) manages the CCB which may also include benefits for children with disabilities and other related programs from provinces and territories.

Who can apply for CCB?

- There are certain conditions to be satisfied. Likewise

- You have to be a resident of Canada and you must have a child less than 18 years of age.

- You are the guardian of that child and solely responsible to take his responsibility.

- You and your partner who is raising the child they should be Canadian resident and also they have the refugee protection claimant document with them.

- You are not allowed to get the CCB for foster child.

Payment amount:

- In March they will get maximum of $7787 yearly which is $648.92 per month for every child you have aged less than 6.

- Then $6571 yearly which is $547.58 per month for every child you have aged between 6 to 17 years.

Application Procedure: Normally the data will be taken automatically while you have registered your child’s birth with the registrar. Otherwise you can apply through CRA My Account online service. By filing the form of RC66 you can apply. Further you can call the CRA at 1-800-387-1193 for assistance.

2. Canada Pension Plan (CPP):

People of Canada can rely on this financial relief for its retired citizens. From various benefits CPP is one of the most important financial assistances among all the benefits provided by CRA. Various changes occurred in 2025 that will affect both present and future recipients. For a layman we can define CPP as a govt.

How can you apply for?

You can apply by logging in to CRA by clicking on My Service Canada Account. After that you have to choose your plan. Then fill all the necessary documents. Proceed for submission after through checking.

Eligibility check:

- Check your eligibility before applying. That, you have to meet certain criteria i.e.

- The claimant should be of 60 years.

- He must have made at least one valid contribution to the CPP.

- To gain the tax benefits at first choose your age while applying.

Payment amount:

If an applicant is 65 years of old then he will get $1433 as the maximum amount for the CPP retirement pension has raised in 2025. This marks an increase of about 2.4% compared to last year’s highest payment.

3. Old age Security Plan (OAS):

OAS scheme is a monthly financial assistance given to senior citizens of Canada. The Service Canada will automatically take all the required data if you are eligible and can automatically sign you up for the OAS pension if they have enough information about you. They will notify you if you have been automatically registered.

Eligibility Check:

You have to be 65 years of old or older whether you are residing in Canada as a resident or you are residing outside but have legal residency.

You have to live in Canada for at least 10 years if you are living in Canada. And if you are living outside of Canada then at least from turning 18, you would have reside in Canada for at least 20 years.

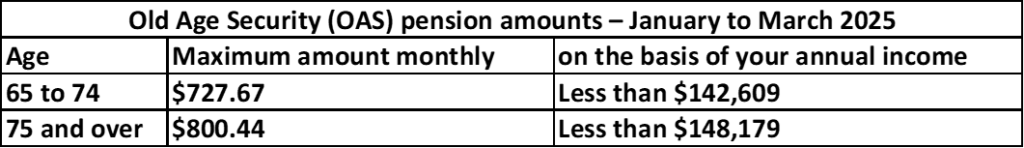

Payment amount:

Procedure of application:

First decide your eligibility that you are eligible to apply or not. Then decide at which age you want to apply. The applying process is as simple as the eligible seniors get automatically signed up when they reach 65 if they have provided their filled tax returns consistently. If someone is not automatically getting the payment then they have a few options to apply. The claimant can do it by applying online using your My Service Canada Account. They have to download the application form then fill it out and send it to Service Canada by mail or else visit a Service Canada office to apply offline.

Bharti Airtel Scholarship 2025 Apply Online: 100% of Annual Fee for Full Course | Free Laptop+Hostel

Bajaj Allianz Two-Wheeler Insurance 2025: Get Insurance in 5 min | No Paper Work Required

Ontario Child Benefit (OCB):

This is a tax free financial assistance designed to support the needy families of Ontario to take care of the children’s expenses. Basically the eligibility depends up on the Canada Child Benefit and also payments from OCB are combined with the CCB. Families are set to get $140 monthly from July 2024 to July 2025. The child’s age must be below 18 years to qualify for this payment. If the income threshold is little bit higher than $25646, you may qualify to get the assistance. The OCB is fully funded by the Province of Ontario but the Canada Revenue Agency manages the program on behalf of Ontario.

Keep visiting the official website of Canada Revenue Agency to know about the particular date and further information.