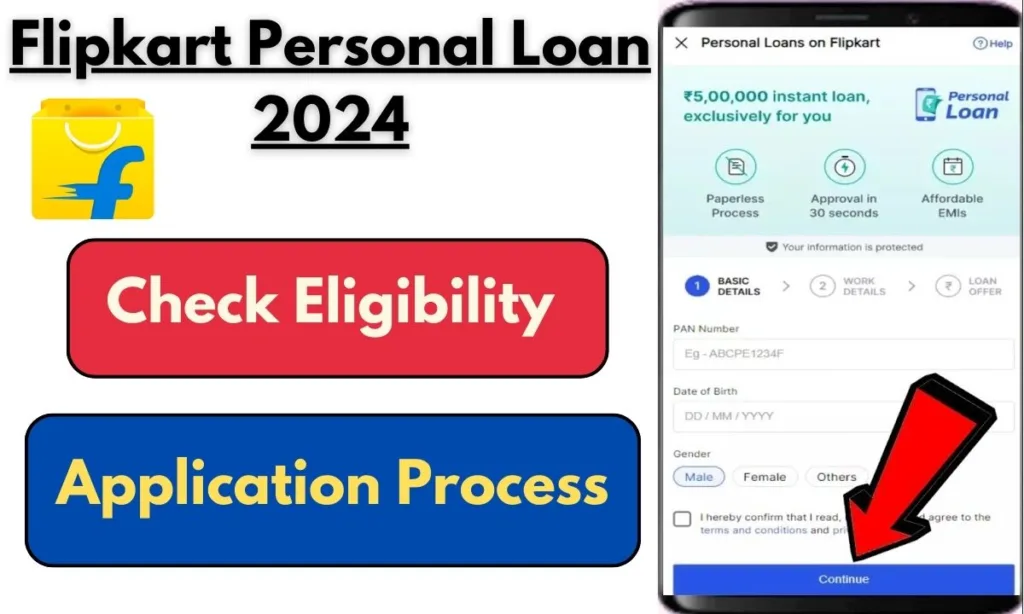

Flipkart Personal Loan 2024: Flipkart is a famous E-Commerce company in India that provides online shopping facilities to their customers. Now the company is expanding its business by providing personal loans to their customers with the help of Axis Bank. So if you are also thinking of a personal loan then can check Flipkart Personal Loan 2024 where you will get an instant loan online mode by using the Flipkart mobile application. Check the Flipkart Personal Loan 2024 eligibility criteria, important document list, application procedure, important documents, interest rates, and additional charges in Flipkart Personal Loan 2024, etc in this article which will help you to apply for the Flipkart Personal Loan 2024 accordingly.

Flipkart is continuously participating with Axis Bank by providing multiple facilities to their customers. Axis Bank is one of the private banks in India which is providing all the banking facilities. Individuals can apply for Flipkart personal loans for multiple purposes including shopping online mode, marriage functions, home decoration, educational purposes, etc. While the Flipkart company was providing loans only to purchase items on the Flipkart platform, now you can apply for loans for multiple purposes other than shopping. The 50000 to 10000 rupees are easily provided by the company and you can also apply for more amount according to your need.

Charges in Flipkart Personal Loan 2024

There are multiple charges in the Flipkart Personal Loan 2024 feature including interest rates of 13.90% and it will increase according to the condition of the customer. The processing fees of 2% will be deducted from the bank account automatically and an additional 18% amount on the processing fees will also be deducted further. Apart from this stamp duty and other charges will also be charged by the company. But you do need not to submit any security deposit to the Flipkart to apply for Flipkart Personal Loan 2024.

Flipkart Personal Loan Eligibility 2024

- Only Indian citizens are eligible to apply for Flipkart Personal Loan 2024.

- The monthly salary from the applicant should be more than 20000 rupees

- Age of the applicant should be between 21 years to 55 years

- You should have a bank account with any National Bank in India.

- The PAN card, Aadhar Card, and bank account should be linked with your mobile phone which should be checked by sending OTP for verification.

Apart from these essential eligibility criteria, you should also have a good CIBIL score and a healthy relationship with the bank in previous years. If you have a good source of income then you can also apply for a maximum loan amount according to your need.

IIFL Home Loans 2024: Check Eligibility, Document Required, Application Process

Flipkart Personal Loan 2024

The application procedure is totally based on online mode but you have to provide the information of the documents and upload essential documents, some documents will also be checked them by the company and the time of video KYC. So before applying for Flipkart personal loan you have to carry the following documents:

- Aadhar Card

- PAN card

- Bank Passbook

- Last 6 month salary slip

- Income tax return document

- Address proof

- Smartphone with internet connectivity

- Mobile number and email ID

NIRA Personal Loan 2024: बिना किसी झंझट रुकावट “1 लाख का इंस्टेंट लोन” जानिए इसकी पूरी जानकारी

Urgent Poor Cibil Score Loan 2024[RBI Approved]: Check Documentation, and Loan Application

Flipkart Personal Loan 2024 application procedure

All The Eligible beneficiaries who have relevant documents can follow the following procedure to apply for Flipkart personal loan scheme 2024 to get instant loan amount:

- First of all visit to the official website of Flipkart company

- Now login to the dashboard by entering your user ID and password for the Flipkart portal.

- After that, you will reach on the dashboard where you have to click on the Flipkart personal loan scheme

- Now you have to enter your personal details including your name, loan amount, EMI, and monthly salary information and upload all the documents

- After that you have to fix an appointment for video KYC

- Once you complete the video KYC the company will approve your loan application and allow the loan amount in your bank account within few hours.