State Bank of India Personal Loan 2025: State Bank of India has become a brand in the banking sector. Today, State Bank of India is not only dealing with banking products but is also providing financial solutions to people. Through this bank, people are currently able to receive loans to meet their financial needs and they are given sufficient time periods to pay the loan and comparatively low interest rate to pay on this loan. In this article today, we will provide you the complete details of this personal loan facility of State Bank of India where we will tell the benefits and whole process of taking loans from State Bank of India

As we all know, State Bank of India is providing various financial solutions to customers. These banks are giving loans up to a maximum of Rs 35 lakh to customers where the interest rate starts from 10.5% per year. This loan is being provided both offline and online. Also, the bank customers are currently able to apply for loans through the Yono app. This loan is proving much better than other banks. The biggest thing is that the State Bank of India is counted among the top and leading banks of the Government of India, so taking a loan from this bank proves to be a profitable deal. Let’s know the complete details of taking a loan from State Bank of India.

State Bank of India Personal Loan Interest Rate and Other Fee

Customers have to pay an interest rate of 10.30% to 15.30% on taking State Bank of India Personal Loan. However, this interest rate completely depends on the age of the customers, the loan amount and the CIBIL score. The State Bank of India also completes the entire verification process before giving the same loan. During this time, customers are given a maximum loan of 35 lakhs, which is provided 7 years to repay. At the same time, a 6 -month Moratorium period is also given. Under this State Bank of India Personal Loan, customers have to pay a processing fee of 5% and also pay a GST charge.

Benefits and features of SBI Personal Loan

- On taking personal loans from State Bank of India, customers get a variety of personal loans where a maximum loan of Rs 35 lakh can be taken.

- Customers are given enough time to repay this loan.

- The processing fee of the loan is also much lower than other banks, which is a maximum of 15000 or 1.5% of the loan amount.

- To take the loan, the customer does not need to give any guarantee and this loan is available on the minimum documentation process, the details of all the fees are already mentioned so that the customers are not kept in any kind of deception.

UAE 10 year Blue Residency Visa 2025 – Learn more about Eligibility & How Indians can apply?

Eligibility and criteria to take personal loan from State Bank of India

- The age of the candidate taking personal loan from State Bank of India is required to be 21 to 18 years.

- This loan is given by SBI to government and private sector employees. In addition, this loan is also provided to businessmen and pensioners doing self -employment.

- LlTo get this loan, the monthly income of the candidate should be ₹ 20000 per month. The fellow candidate must have all the necessary documents.

Loan EMI Calculator State Bank of India

Loans are provided by SBI based on customers’ needs. Before taking this loan, customers can also calculate their EMI through the EMI calculator from the official website. For example, if the customer wants to get a loan of 2.5 lakhs and it is charged 10.30% interest rate, then the applicant will have to pay an EMI of Rs 5340 every month for a period of 5 years.

Can do SBI’s official website or the Yono app. After doing an accurate song of EMI, the candidate can accept the loan offer and apply for the loan amount.

State Bank of India Personal Loan : no Guarantors Required?

In the State Bank of India, customers are being provided with personal loans without guarantee. However, there are many banks that still demand guarantees before giving a loan so that if the candidate is not able to take the loan, then the guarantor can be charged. In such a situation, many times candidates make their husband-wife or close relatives gender, due to which the guarantor is harassed in the death or emergency situations of the person taking the loan. But no such condition is laid by the State Bank of India.

The State of India Loan does not demand a guarantee for approval nor the guarantor is harassed. The State Bank of India has abolished the need for permanent or guarantee, considering the safety of the spouse as compulsory under the individual loan. However, before giving a loan, the State Bank of India definitely pays attention to other components such as the financial stability of the applicant, their credit score and their income status.

State Bank of India Personal Loan required documents

To get a personal loan from State Bank of India, the applicant has to submit a PAN card, Aadhaar card, voter ID card, passport, driving license, their utility bill, salary slip, form 16 and bank statement.

How to get a loan from State Bank of India?

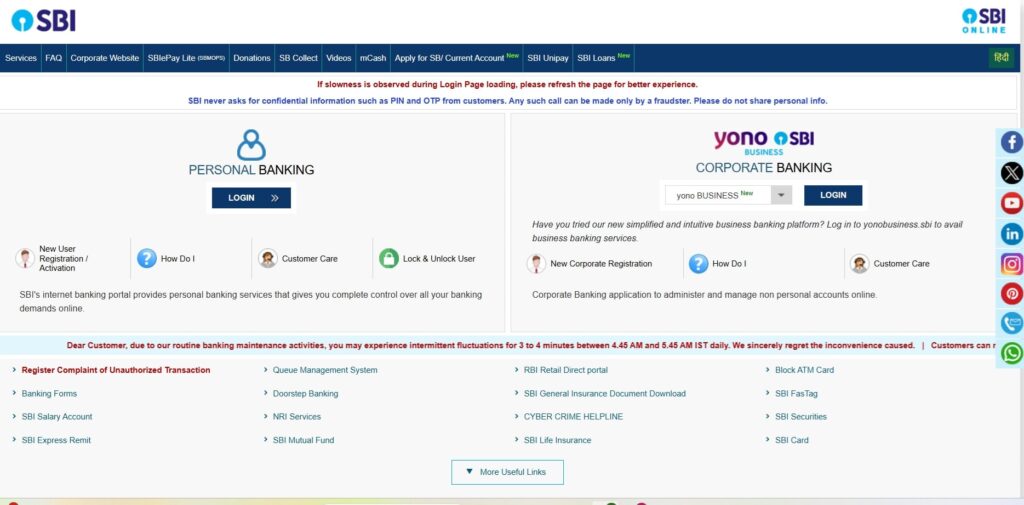

To get a loan from SBI, the applicant can apply for an online loan through the Yono app. Where the applicant will have to install the vano app in his mobile. You have to login to the app. After logging, you have to click in the loan section. Personal loan option has to be selected here, after which the loan amount period and OTP verification will have to be done. After filling the details, approval is received for the loan and the bank is sent to your account.

$2500 Cash App Class Action Settlement – Check Online Application Process And Payout Information

$2000 4th Stimulus Check in May 2025 – Check Eligibility and Payment Date

SBI Personal Loan Offline Application

You can also apply offline for SBI loan where you have to first go to the nearest SBI branch to take the loan. In the SBI branch, you have to get a loan form from the representative. After this, you have to fill this form carefully and submit it to the form bank with the documents sought.