BOB Mudra Loan Apply 2024: The Mudra loan scheme is a very effective scheme of the Central Government which is provided by Partner banks with this scheme. This is a specific loan feature to promote Entrepreneurship and small and medium businesses in India in villages and all the cities. Bank of Baroda is also providing benefits of PM Mudra loan where applicants will get a maximum of 10 lakh Mudra loan. So if you are also an existing customer of Bank of Baroda and are searching for a BOB Mudra Loan Apply then you can read this article where we are sharing with you the eligibility criteria for a BOB Mudra Loan Apply including important documents, online application procedure, interest rates, etc.

Bank of Baroda has a large network in India in every city. The bank is providing Bob Mudra loans to its existing customers. A Mudra loan is very beneficial for those individuals who want to start a new business or want to upgrade their business with financial assistance from the bank as a loan. While other business loans have additional terms in conditions, a Mudra loan is designed for micro small, and medium enterprises so there are minimum conditions for business holders, they will not need to submit any security while BOB Mudra Loan Apply.

BOB Mudra Loan Apply 2024

Bank charging Bob Mudra loan interest rates from 1% to 20% according to the condition of the customer. There are three types of Mudra loans available in the Bank of Baroda including Shishu Mudra loan for up to 50000, Kishore Mudra loan for amounts between 50000 to 5 lakh rupees, and Tarun Mudra loan for a maximum of 10 lakh rupees. If you are BOB Mudra Loan Apply digitally then you can get Shishu and Kishore Mudra loan instantly in your bank account.

Eligibility criteria for BOB Mudra Loan Apply

- Only Indian citizens who are existing customers of the Bank of Baroda are eligible to apply for the Bank of Baroda loan scheme

- The age of the applicant should be more than 21 years old

- Bob Mudra Loans can be used for a variety of purposes, including business expansion, working capital requirements, and purchasing new equipment. If you are an MSME looking for a loan, Bob Mudra Loans are a great option to consider.

- The customer has a good CIBIL score and should not engage in any other type of loan from Bob and another bank

Documents for 2024 BOB Mudra Loan Apply

You need to carry the following documents and that time of applying online in scanned document form:

- The Aadhar card of the applicant

- PAN card

- business registration with Udyam Hotel

- GST registration number

- Bill of the equipment which will be purchased by using the loan amount of Mudra loan.

- Address proof of the applicant

- Bank account details

BOB Mudra Loan Apply Online 2024

We are discussing with you the online application procedure for the Bank of Baroda Mudra loan, however, if your branch is very near to you and you are suitable to visit the branch then you can apply by visiting the branch directly. If you are going to apply online then follow this procedure;

Visit to official website of Bank of Baroda. This is the direct link to the website https://www.bankofbaroda.in/

Now click on the loan section and after that select Digital Mudra loan

- You can see the features of the loan and other information on the portal and after that click on the apply now link

- Now you will be redirected to the new portal of the Government of India as Jan Samarth Portal.

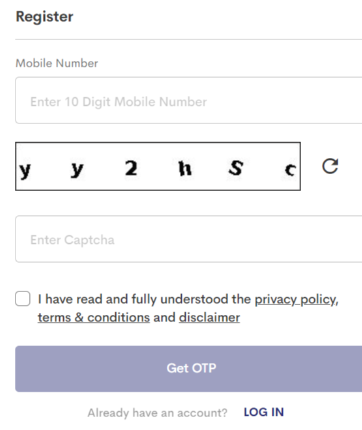

- You have to register yourself on this bottle before applying online with your mobile number which is linked with the Bank of Baroda and after that, you will get OTP for verification

- Now submit your personal information and other details on the website and create a user ID and password for login

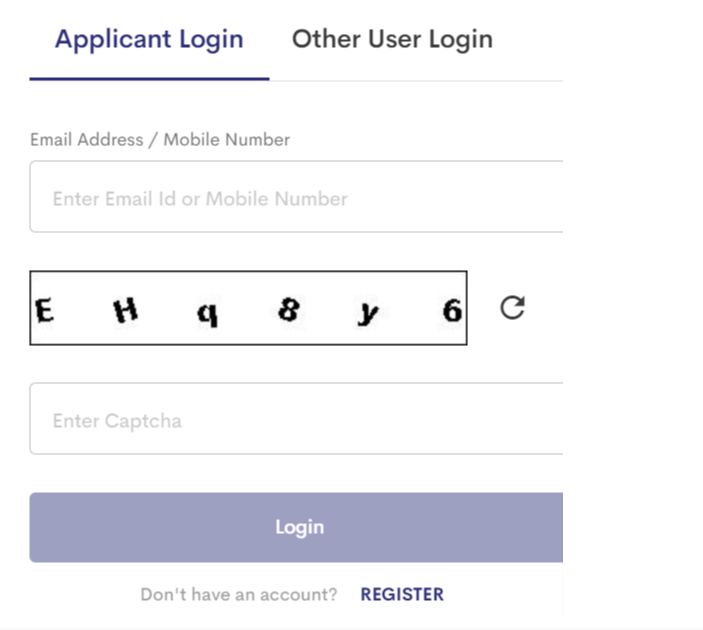

- Now enter your email ID on your mobile number which is used at the time of registration and enter the capture code for login. You will receive OTP at the time of login every time

- Now you can access the portal where you have to click on the link of the scheme and after selecting a business scheme, you will find the Pradhan Mantri Mudra loan scheme in this section

- You can check all the information in this portal and after that click on Apply now

- After that enter your bank details on the website and submit your application. The system will verify your details and after that, you will get the loan amount in your bank accounts instantly.