IIFL Finance Business Loan 2024: Entrepreneurs seeking to start or expand their businesses rely heavily on business loans. IIFL Finance has continuously introduced innovative financial products to cater to the needs of businesses in search of funds. Specifically designed for small and medium enterprises, IIFL Finance Business Loan 2024 serves as a crucial source of capital. This comprehensive product, known as the MSME business loan, provides quick funds to support the growth of your small business and enable investments in essential infrastructure, machinery, plants, operations, advertising, marketing, and more.

For new businesses, IIFL Finance Business Loan 2024 is an ideal source of capital to fulfill all their business requirements. The IIFL Finance Business Loan 2024 interest rate offered by IIFL Finance is both attractive and affordable, ensuring that entrepreneurs do not have to compromise on essential expenses. Through thorough market research, the instant business loan process has been tailored to be the leading business loan option in India.

IIFL Finance Business Loan 2024

IIFL Finance Ltd. offers immediate IIFL Finance Business Loan 2024 to Micro, Small and Medium Enterprises (MSME) for loan tenures of up to 5 years. The IIFL Finance Business Loan 2024 interest rates begin from 12.75% p.a. for its unsecured business loan.

The non-banking financial company (NBFC) claims to offer MSME business loans with 100% online loan processing right from application to disbursation and loan approval within minutes.

IIFL Finance Business Loan 2024 : Highlights

SSC CPO Answer Key 2024 (Released 6 July): Download SI and CAPF Paper 1 Response Sheet [PDF]

Benefits of IIFL Finance Business Loan 2024

IIFL Finance offers business loans that come with complete transparency. One of the key advantages of IIFL Finance Business Loan 2024 is that you do not need to provide collateral, and the loan amount will be disbursed to you within 24 hours. The application process is simple and can be done online with minimal paperwork. Additionally, the attractive interest rates offered by IIFL Finance ensure that repaying the loan does not put a strain on your finances.

With a IIFL Finance Business Loan 2024, you can receive the funds quickly, allowing you to smoothly run your operations or implement your business expansion plans.

- A business loan provides the flexibility needed to manage cash flow effectively. Instead of depleting your available cash to cover expenses, you can use the loan to spread out expenditures over time. This helps your business maintain a healthy cash flow and avoid financial difficulties.

- By investing in marketing, advertising, and other promotional activities, a business loan can help you build a strong brand and reputation. Increased visibility and attracting new customers become possible through these initiatives.

- Applying for a IIFL Finance Business Loan 2024 is hassle-free and does not involve extensive paperwork. Some borrowers may even qualify for loans without the need for collateral, guarantor, or security, making it easier to meet their business expansion needs. Additionally, doorstep services are offered by several lenders for added convenience.

- IIFL Finance Business Loan 2024 with competitive interest rates allow you to save money on borrowing costs. These savings can then be utilized to invest in business growth and expansion. Moreover, low-interest loans contribute to better cash flow management and financial stability for your company.

- Regularly making payments on a business loan can help improve your business’s credit rating. This demonstrates your financial responsibility and enhances your chances of obtaining credit in the future.

IIFL Finance Business Loan 2024 Eligibility

- Your business must have been in operation for a minimum of 2 years when applying.

- The business should not be blacklisted or excluded from any category or list.

- The office or business location should not be on the negative location list.

- Charitable organizations, NGOs, and trusts are not eligible for a business loan from IIFL Finance.

Documentation for IIFL Finance Business Loan 2024

The Documentation for IIFL Finance Business Loan 2024 for obtaining an IIFL Business Loan vary depending on the amount of the loan.

For a loan amount of 10 Lakhs:-

- KYC documents, including identity proof and address proof for the borrower and all co-borrowers, PAN Card for the borrower and all co-borrowers, the last 6 months’ bank statement of the main operative business account (preferably 12 months for maximum loan amount), and a signed copy of the standard terms for the term loan facility. Additional documents may also be required for credit assessment and loan processing.

For a loan amount of 30 Lakhs :-

- KYC documents – Identity proof and address proof of the borrower and all co-borrowers.

- PAN Card of the borrower and all co-borrowers.

- Last 6-12 months bank statement of the main operative business account.

- Signed copy of standard terms for the term loan facility.

- Additional document(s) may be required for credit assessment and processing of the loan request.

- GST Registration.

- Previous 12 months’ bank statements.

- Proof of business registration.

- PAN Card and Aadhar Card copy of the Proprietor(s).

- Deed copy and company PAN Card copy in the case of partnerships.

TCS Latest Jobs 2024 (Out): Graduates TCS Career Opportunities, Apply Online Now

SSC GD Physical Test 2024 Notice: PET/PST Dates & Requirements for Male & Female

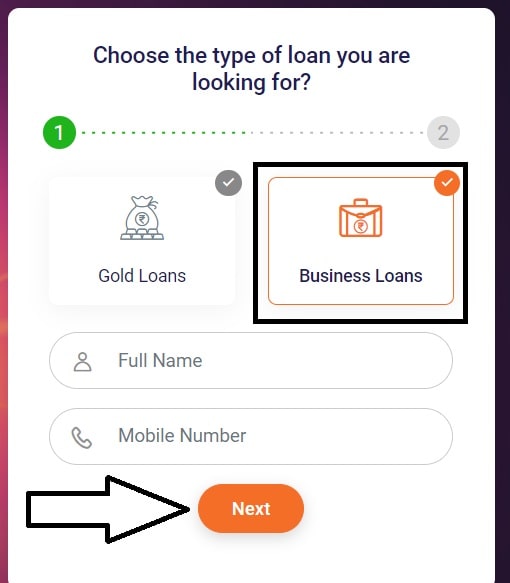

IIFL Finance Business Loan 2024 Apply Online

To apply for IIFL Finance Business Loan 2024 with IIFL, follow these steps :-

- Login to IIFL Finance website : https://www.iifl.com/.

- Select ‘Business Loans’ from the menu bar.

- Click on ‘Apply Now’ to progress to the next page.

- You will be directed to the application form. Here, you enter your name, phone number, Aadhar and PAN card details.

- These details will be processed to determine your loan entitlement.

- You can select the loan amount you want and submit your application.

- You will then be required to upload your bank account details, business documents, PAN & Aadhaar copy, and other kyc documents to complete the loan processing.

- Once these documents have been confirmed, your loan is approved. You will be informed through SMS and email regarding your loan processing.

- The loan sum will be credited to your bank account within 48 hours of loan approval.

IIFL Finance Business Loan 2024 Interest Rates

IIFL Finance Business Loan interest rates ranging between 12.75% p.a. and 44.00% P.A.

IIFL Finance Business Loan Fees and Charges

Processing fees :-

| Particulars | Rates |

| Processing fees | 2% to 6% plus GST with an additional amount of up to Rs 500 charged as Convenience fees |

Prepayment / Foreclosure Charges :-

Other charges for IIFL Finance Business Loan 2024 :-

| Particulars | Rates |

| Cheque or ACH return charges | Rs 500 plus GST per instance |

| Cheque or ACH swapping charges for duplicate no-dues certificate | Rs 500 plus GST per instance |

| Duplicate statement / Repayment schedule / Amortisation / Sanction letter / Agreement | Rs 200 plus GST per instance |

| Penal interest | 24% p.a. |

| EMI bounce charge | Up to Rs 1,200 |

| Loan cancellation | Interest to be charged for the interim period between the date of disbursement and date of cancellation of loan |

| Any other charges on case to case basis | At actuals |

CSC Aadhar UCL Registration 2024: Steps Aadhar Update UCL Software Install & Check Status

India Post GDS Recruitment 2024 Apply Online, 40,000+ Posts, Eligibility 10th 12th Graduate [Form]

IIFL Finance Business Loan 2024 Repayment

IIFL Finance Business Loan 2024 can be comfortably reimbursed in 5 years. The EMIs are generally paid through ECS or NACH mandate submitted during the time of loan disbursal. If you want other ways to pay, here they are : –