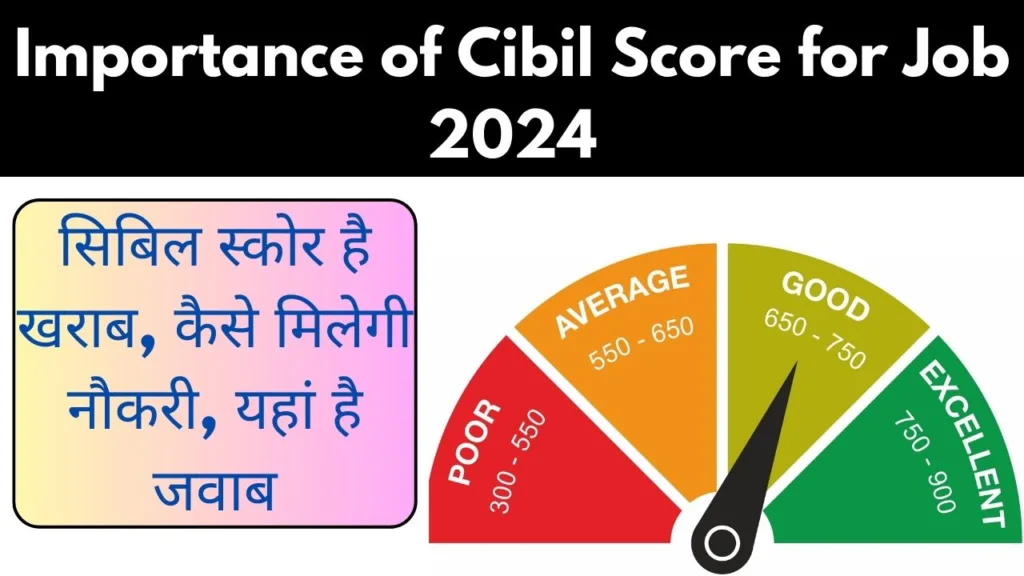

Importance of Cibil Score for Job 2024: The CIBIL score is a very important factor for individuals to apply for personal loans or any other type of financial services from the bank. But now the CIBIL score is going to become more important as authorities have started to add CIBIL score in one of the eligibility criteria to provide jobs. So if you are a job-less person and seeking for job then you should maintain your CIBIL score as it has now become more important for youths, It will not only impact your banking history and services but will also impact your service or job life.

There are many individuals and youth who want to get government jobs to secure their future and work hard to prepare for government jobs. But if your CIBIL score is low then you will have difficulties getting a government job over your hard studies. Recently, Indian Banking Personnel Selection- IBPS has uploaded a notification regarding the eligibility for government jobs in government banks in India. According to this Importance of Cibil Score for Job 2024 notification, all the candidates whose CIBIL score is less than 650 will not be allowed to appear in the recruitment procedure until they increase their CIBIL score.

Importance of Cibil Score for Job 2024

If you are preparing for a Government bank job then you should maintain your CIBIL score. However, IBPS has also mentioned that recruitment in all the government banks excluded SBI will only allow the applicants to join their banks after getting proper NOC from the bank where they have a savings account. So if any candidate has less than a 650 CIBIL score then the bank will not allow him NOC. In the end, these applicants will not be able to join their jobs in government banks.

| Credit Score Name | CIBIL |

| Year | 2024 |

| CIBIL Score Range (Start) | 300 |

| CIBIL Score Range (End) | 900 |

| Low CIBIL Score Impact | Jobs |

| Importance | Consider CIBIL Scores for Financial Responsibility-based Positions |

| Checked Details | Past and Present Debts, Repayment History, Examples, etc. |

| CIBIL Score for Job (Min) | 650 |

| Recruitment Procedure | Available |

| Latest Updates on CIBIL Score for Job | Check Online Sources |

Why CIBIL score is very important in the bank?

Importance of Cibil Score for Bank Job 2024: The CIBIL score is a 3-digit value that is provided to the customer from the bank. Multiple factors determine the CIBIL score including use of credits, credit limits, repayment of the loan, etc. If you have a good relationship with the bank then your CIBIL score will automatically increase. The range of CIBIL score is between 300 to 900 where 300 is the very lowest CIBIL score while 900 is the best CIBIL score. So if you have more than 750 score then it is considered a good CIBIL score. However, if you are preparing for a government job in the bank then your CIBIL score should be more than 650 which is also enough. Apart from the government job, you may also face difficulties while applying for a personal loan because of your bad CIBIL score

Difficulty in loan on low CIBIL score

A personal loan is a financial facility provided by the bank to their customers but it is provided only to trustable customers. CIBIL score is also an indicator of trustworthiness, So if you have a bad CIBIL score then the bank will not approve your loan application and reject it based on a bad CIBIL score. Apart from this, other banks can also check your CIBIL score easily and will also not provide you with any other type of loan.

Canada Grocery Rebate Payment 2024: Check Eligibility, Next Payment Date & Status, @canada.ca

Uttarakhand Bhu Kanoon: उत्तराखंड में जमीन नहीं खरीद पाएंगे बाहरी लोग, नया कानून

Tips to increase CIBIL score (Importance of Cibil Score for Job 2024)

If you are engaged in any type of loan then you should submit the EMI monthly before the deadline to increase your CIBIL score. Banks provide credit limits to customers while providing credit cards, but you should not use 100% credit limits as it will automatically reduce your credit score or CIBIL score. You should not use more than 30% of your credit limits. However, if your CIBIL score is already down then you can apply for a short-term personal loan and repay the loan amount timely. This practice film increases your CIBIL score in the bank. Every time you delay the bills and EMI your chances of decreasing your CIBIL score will be high. So you should submit your all pending amounts before the deadline.