Sukanya Form 2024: Under this Sukanya Samriddhi Yojana 2024, you can get a huge amount through small savings for your daughter. Under this Sukanya scheme, you have to invest some money that will be suitable for your daughter’s marriage and higher education. Know more about How to Fill Sukanya Form 2024.

Sukanya Samriddhi Yojana 2024 is a government-supported (SSY)small savings scheme for the benefit of the girl child. It is part of the “Beti Bachao, Beti Padhao” scheme and can be opened by parents of girl children who are below 10 years of age. Sukanya Samriddhi Yojana 2024 accounts can be opened in designated banks or post offices. account is for 21 years or until the girl goes for marriage after the age of 18 years. This scheme comes with many tax benefits and higher interest rates. Read the entire article to know more about the details of Sukanya Samriddhi Yojana 2024.

Interest rate of the Sukanya Samridhhi Yojana

After increasing the interest rates in Sukanya Samriddhi Yojana 2024, now the government has decided to provide Sukanya Samriddhi Yojana interest to the customers at the interest rate of 8.20 percent instead of the earlier 8 percent. This Sukanya scheme has been started by the Central Government and its objective is to strengthen the future of the daughters of the country. Lakhs of daughters across the country are taking benefits after filling the Sukanya Form 2024.

List of banks for opening SSY account

- Indian Stat bank

- PNB

- Bank of India

- Punjab and Sindh bank

- Union Bank of India

- bank of Maharashtra

- State Bank of Hyderabad

- Allahabad Bank

- Oriental Bank of Commerce

- Canara Bank

SBI PO Notification 2024: Check PO Pre + Mains Dates, Form, Exam Pattern, Syllabus @sbi.co.in

Rojgar Sangam Bhatta Yojana 2024 : Check Eligibility, Benefits, Apply Online, @sewayojan.up.nic.in

Sukanya Installments 2024

Under the Sukanya Samriddhi Yojana run by the government, the minimum investment limit has been set at Rs 250 and the maximum at Rs 1,50,000. To open an account under this Sukanya Samriddhi scheme, you can go to the nearest post office or bank. Lakhs of daughters of the country will benefit from the increased interest rates announced by the government for the first quarter of 2024.

Documents Required to Fill the Sukanya Form 2024

If you want the benefits of this scheme, then you have to apply for it. Here below we have provided you with all the necessary documents, that you need while filling out the Sukanya Form 2024.

| birth certificate of girl child | Aadhar Card of the girl child (if available) |

| residence certificate | PAN card of parents |

| Aadhar card of parents | mobile number |

Benefits of the Sukanya yojana as per the instalment

Here below we have mentioned the details of the benefits as per the instalment rate

| 1000 per month | 1.80 lakh | 5.70 lakh |

| 2000 per month | 3.60 lakh | 11.40 lakh |

| 3000 per month | 5.40 lakh | 17.11 lakh |

| 4000 per month | 7.20 lakh | 22.51 lakh |

| 5000 per month | 9.00 lakh | 28.51 lakh |

| 12500 per month | 22.5 lakh | 73.90 lakh |

Aspire Leaders Scholarship 2024: ₹8,00,000 की छात्रवृत्ति, आज ही करें आवेदन, लास्ट डेट 3 जुलाई

Benefits of the Sukanya Samridhhi scheme

Here below we have mentioned the benefits of the Sukanya Samridhhi yojana

- The minimum investment is ₹250 annually; The maximum investment is ₹1,50,000 annually. Full term is 21 years.

- Currently, the Child Savings Account comes with multiple tax benefits and the highest rate of interest among all small savings schemes, i.e. 8.0% (for the period 01.04.2023 to 30.06.2023).

- The principal amount deposited, interest accrued, and asset gains during the entire tenure are tax free under Section 80C.

- Account can be transferred from one post office/bank to another anywhere in India. If the account is not closed, interest can be paid even after the full maturity period.

- Even after the child completes 18 years of age, if she is not married, a pre-condition withdrawal of up to 50% of the investment is allowed.

What are the eligibility criteria to Fill Sukanya samriddhi scheme Form 2024

- A secured account, with any one of more than one patron, can be opened in the name of a minor girl. This means that the age of the girl should be less than ten years on the date of account opening.

- Under this scheme, each account holder will have only one account.

- An account can be opened under this scheme for more than one girl child in a family. It is provided that if such children are born first or second in succession, more accounts can be opened in the family, if so, accompanied by an affidavit by the guardian, citing birth certificates in respect of the birth of such girls. Have support.

- Further, the above provision will not apply if the family consists of two or more surviving girl children by first birth, if there are two or more surviving girl children by first birth.

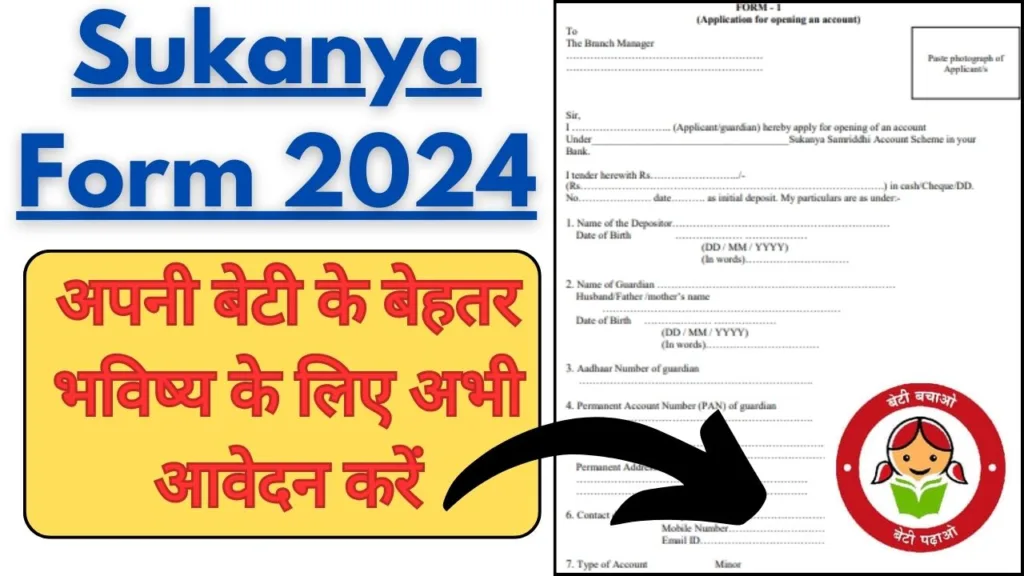

How to Fill Sukanya Samriddhi scheme Form 2024?

Sukanya Samriddhi Yojana (SSY) account can be opened in any major bank or post office branch. To open an account, complete the steps below:

- Go to the bank or post office where you want to open an account.

- Fill in the required information in the Sukanya application form 2024 and attach supporting documents.

- Make the first deposit in cash, cheque, or demand draft. The payout can range between Rs.250 to Rs.1.5 lakh.

- Your application and payment will be processed by the bank or post office.

- After processing, your SSY account will be activated.

- A passbook will be provided for this account to commemorate its opening.