Aadhar Card Link with PAN Card in 2024: If you haven’t linked your PAN card with your Aadhaar card yet, you can now do it online in 2024 by paying a fee of just ₹1,000. In this article, we will provide you with detailed information about how to Aadhar Card Link with PAN Card in 2024. Stay with us to get all the necessary details.

If you haven’t linked your PAN card with your Aadhaar card yet, you can now do it online by paying a fee of just ₹1,000. We will guide you through the process of linking PAN Aadhaar online in 2024 in detail through this article. We will explain the easiest process, known as Aadhar Card Link with PAN Card in 2024 Easy Way. For this, you need to have your PAN card number and Aadhaar card number ready. This will help you easily link your PAN card with your Aadhaar card.

Overview Of the Article – Aadhar Card Link with PAN Card in 2024

| Department Name | Income Tax Department, Government of India |

| Title of the article | Link Your Aadhar Card with Your Pan Card in 2024 |

| Type of the article | Government documentation update |

| Is Aadhaar Card – PAN Card Linking Compulsory? | Yes! it is compulsory |

| Mode of Linking | Online |

| Charges for Linking | None |

| Online PAN Aadhaar Link Charge | ₹1,000 |

| Requirements | Your Aadhaar Card Number + PAN Card Number, etc. |

RPSC RAS 2024 Notification PDF, Check Eligibility, Fee, Exam Date (Oct) & Selection at rpsc.rajasthan.gov.in

In this article, we warmly welcome all PAN cardholders who wish to link their Aadhaar card with their PAN card means Aadhar Card Link with PAN Card in 2024. We aim to provide detailed information on how you can now link your PAN card with your Aadhaar card by simply making a payment of ₹1,000. Therefore, through this article, we will guide you extensively on Pan Aadhaar Link Online 2024, ensuring that you stay with us to obtain complete information.

Benefits of linking your Aadhar card with PAN card

- Tax Filing Made Simple: Linking Aadhaar with PAN makes filing taxes easier and reduces errors.

- Reduced Fraud Risk: Connecting Aadhaar and PAN helps the government verify identities better, lowering the risk of fraud.

- Quick Access to Government Services: You can access government services faster, ensuring they reach the right people.

- Simplified Financial Transactions: Online banking and investing become simpler when Aadhaar and PAN are linked.

- No need to carry lots of IDs: You no longer need multiple IDs, making things less complicated.

- Efficient Identity Verification: Linking Aadhaar and PAN enables quick verification for tasks like opening bank accounts or applying for loans.

RRB ALP Vacancy 2024 Revised List (Zone Wise) for 18799 Assistant Loco Pilot

SBI Recruitment 2024: आधिकारिक नोटिफिकेशन जारी, Manager पोस्ट्स Apply Online, लास्ट डेट 20 जुलाई

Follow These Steps to Aadhar Card Link with PAN Card in 2024

To link your PAN card with your Aadhaar card, you need to follow certain steps, which are as follows:

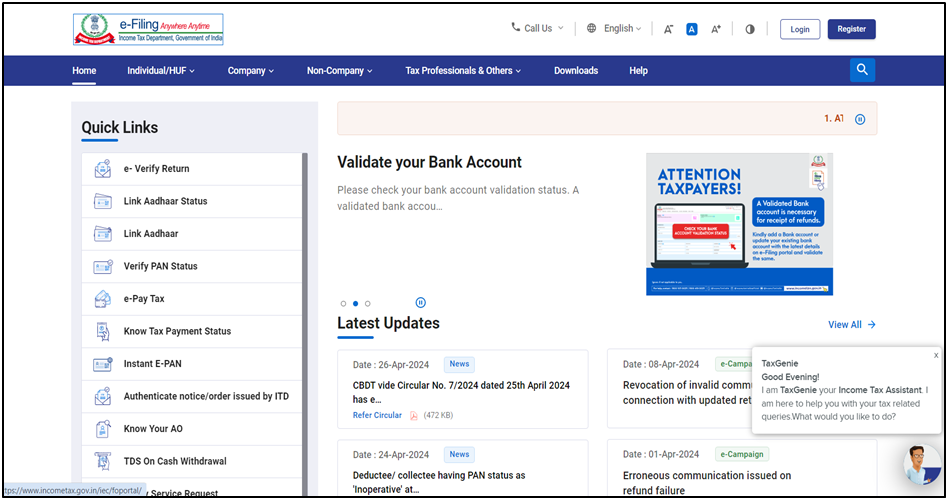

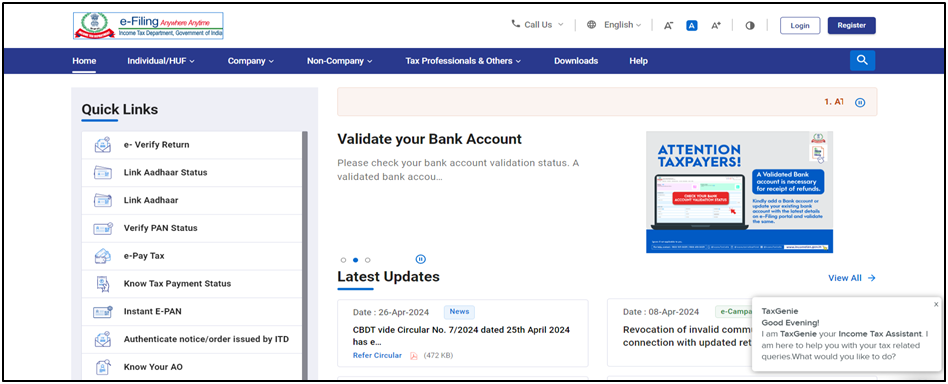

- Visit the official website of Pan Aadhaar Link Online 2024. The homepage will appear like this:

- After reaching the homepage, you will find the option “Link Aadhar” under the Quick Links section. Click on it.

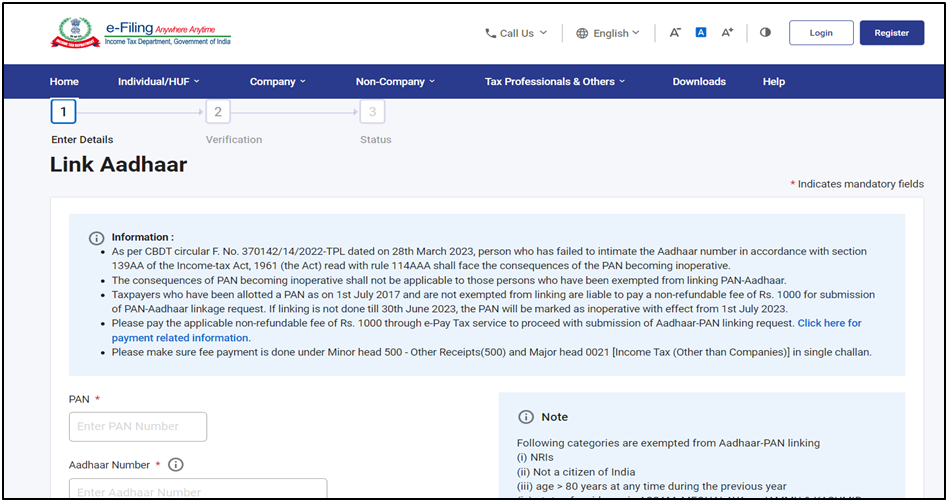

- Clicking on it will open a new page where you need to enter the required information and click on the “Proceed” option.

- After clicking, a pop-up will appear

- Here, you will find the option “Continue to Pay Through E Pay Tax.” Click on it.

- Clicking on it will open a new page. Here, you need to carefully enter all the information.

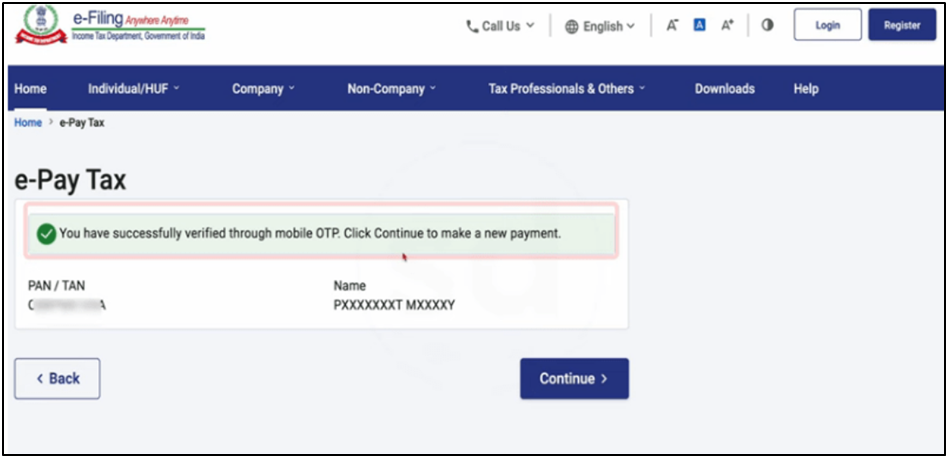

- After that, you need to undergo the OTP verification and click on the “Proceed” option, after which a page like this will appear:

- Here, you will find the option “Continue.” Click on it.

- Clicking on it will open a new page. Under “Income Tax,” click on the “Proceed” option, after which the payment page will open.

- Here, you need to select the best payment option from the various options available and click on the “Proceed” option.

- After clicking, you will be required to make a payment of ₹1,000.

- Finally, you will get the option to download the payment slip.

- By following the above steps, you can easily link your PAN card with your Aadhaar card and avail its benefits.

SSC CPO Answer Key 2024 (Released 6 July): Download SI and CAPF Paper 1 Response Sheet [PDF]

CTET Result 2024[July]: Check Qualifying Marks, Download Papers I & II Scorecard

How you can check whether your Aadhar card is linked or not with your Aadhar card?

To ensure that your PAN card is linked with your UID card, it’s essential to verify its status. Here’s a detailed guide on how to do so:

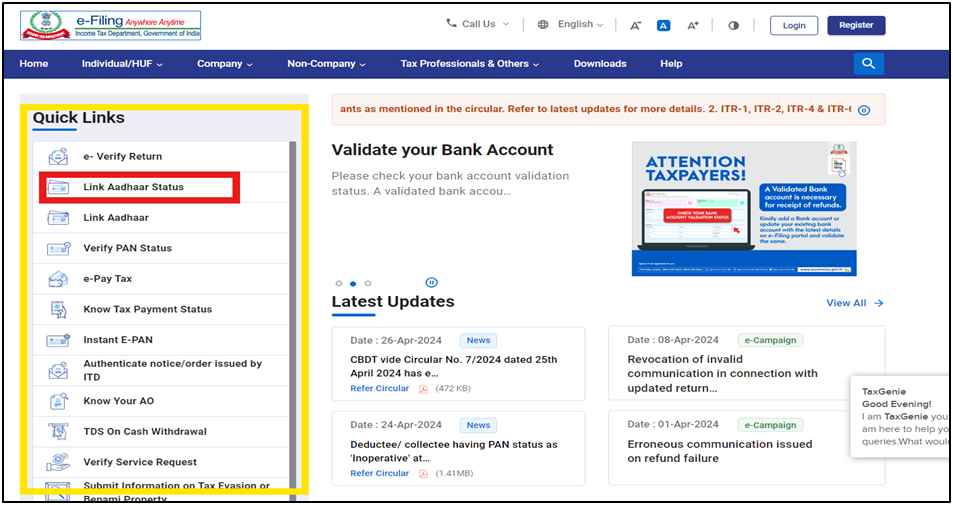

- Access the Official Website: Begin by visiting the official website designated for PAN Aadhaar Link Online 2024.

- Navigate to Quick Links: Upon reaching the homepage, look for the “Quick Links” section. This section typically provides shortcuts to various services.

- Select Link Aadhaar Status: Within the “Quick Links” section, locate and click on the option labelled “Link Aadhaar Status”. This option directs you to the page where you can check the status of your PAN-Aadhaar linkage.

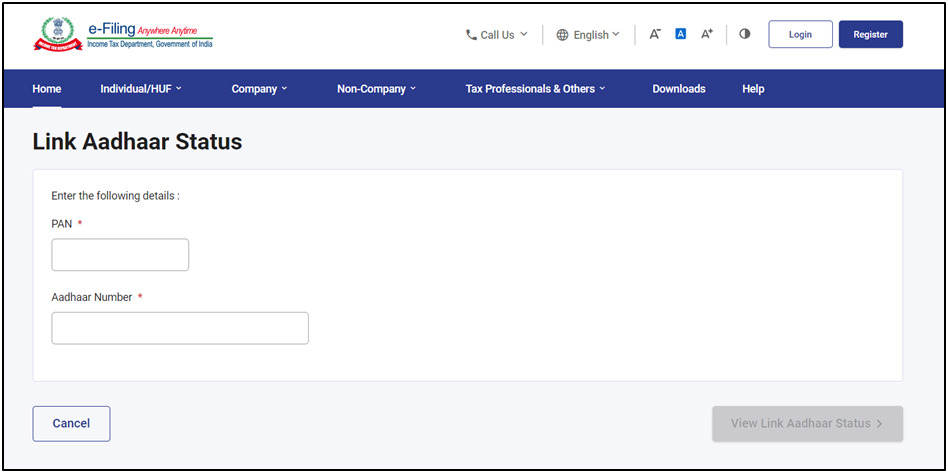

- Enter Required Details: Once you’re on the status page, you’ll be prompted to enter specific details. Input your Aadhaar card number and PAN card number accurately into the designated fields.

- Submit Information: After entering the necessary details, proceed by clicking on the “Submit” button. This action submits the information you provided for verification.

- View Your Status: Following the submission, your status regarding the linkage of your PAN card with your Aadhaar card will be displayed on the screen. This status confirms whether the two cards are linked or not.

By following these steps, you can effortlessly confirm the status of your PAN card’s linkage with your Aadhaar card. This verification process ensures that you can avail yourself of the associated benefits seamlessly.