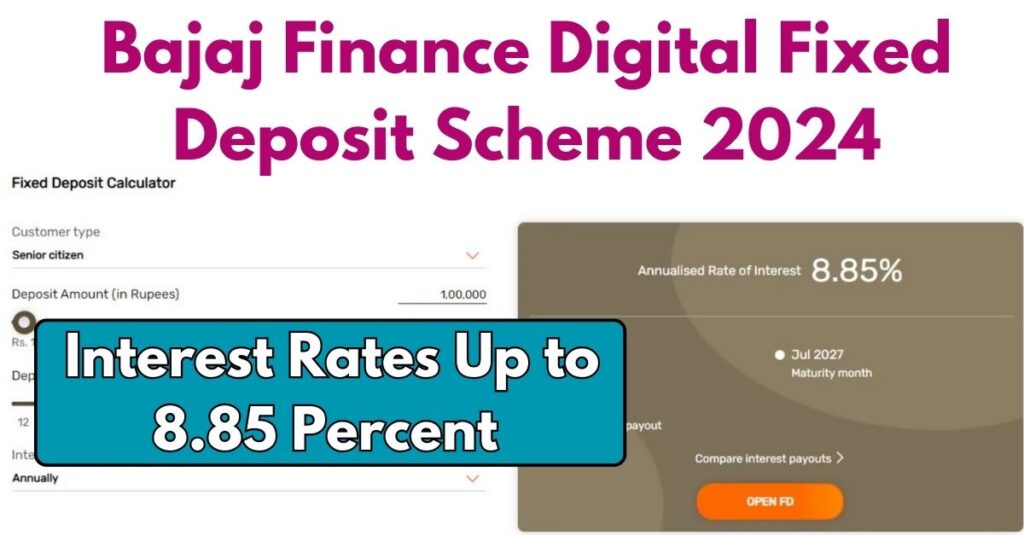

Bajaj Finance Digital Fixed Deposit Scheme 2024: Fixed deposit- FD is a very fast-growing scheme in India. Bajaj Finance provides a digital FD scheme to their customers where you can get up to a maximum of 8.85% annual interest from the company on your deposits. Bajaj Finance FD offers fixed deposit interest rates up to 8.60% p.a. for non-senior citizens. Senior citizens can earn up to 8.85% p.a. They get an additional rate benefit of up to 0.40% p.a. on their deposits. The company has recently increased and revised the interest rates for every scheme in the year 2024.

So if you are planning to invest in an FD scheme in Bajaj Finance then you can check the latest information and latest interest rates of Bajaj Finance digital fixed deposit scheme 2024 in this article. Bajaj Finance is offering a Bajaj Finance Digital Fixed Deposit Scheme 2024 to invest the amount for the next 42 months. Where citizens will get annual interest rates from the company according to the deposit amount. Apart from this, senior citizens are getting special benefits to get maximum interest rates on their deposits.

These deposits will get back after completing the maturity of 42 months with additional interest rates which you have earned during this period.

Bajaj Finance Digital Fixed Deposit Scheme 2024

Bajaj Finance Digital Fixed Deposit Scheme 2024

Bajaj Finance Digital Fixed Deposit Scheme 2024: You can start the FD scheme in Bajaj Finance with a minimum investment of 15000 according to the official website. However, you can deposit the maximum amount of 5 crore rupees if you are eligible. Companies have different interest rates for different tenures of the FD scheme which starts from 12 months. You can select up to a maximum of 60 months for every scheme in Bajaj Finance.

Covid Flirt Variant are Circulating Fast; Know the Symptoms, Severity

Bajaj finance FD interest rates 2024

The maximum intersects are provided for the Bajaj Finance Digital Fixed Deposit Scheme 2024 of 42 months however the company is also providing special interest rates for 15 months, 18, 22 months, etc. If your age is less than 60 years then you will get a maximum interest rate of 8.60% if you select 42 months for every scheme in Bajaj Finance in the year 2024.

7.45% interest rates will be given for 15 and 30-month FD schemes, 7.40% will be provided for 18-month FD schemes, 7.75% interest rates will be given for selecting 33 months FD and 8.35% Will be provided for 44 months FD. If you are a senior citizen and aged more than 60 years then you will get a maximum 8.85% interest on 42 months FD scheme in Bajaj Finance.

7.70% interest will be given for the FD of 15 months and 30 months, and 7.65% will be given for the 15-month FD. 8% will be provided for 33 months and 8.60% will be provided for 44 months every scheme. So any individual either less than 60 years old or senior citizen person can invest in the Bajaj Finance FD scheme through digital mode by visiting the official website of Bajaj Finance and starting your scheme without visiting the branch instantly.

Bajaj Finance FD Scheme 2024

A Fixed Deposit (FD) is a financial instrument offered by banks and financial institutions where an individual deposits a lump sum amount for a fixed tenure at a predetermined interest rate. The main benefits of FD include capital preservation, as the principal amount is secured, and a guaranteed return on investment due to the fixed interest rate. FDs provide a stable and low-risk investment option, making them suitable for conservative investors looking for a secure way to grow their savings.

Additionally, FDs offer liquidity through premature withdrawal options, although this may come with certain penalties.Overall, Fixed Deposits serve as a reliable tool for individuals seeking a steady and predictable income stream while safeguarding their initial investment. Furthermore, Fixed Deposits offer a convenient avenue for long-term financial planning and goal fulfillment.

With the assurance of a fixed interest rate throughout the chosen tenure, investors can calculate and anticipate their returns accurately, aiding in budgeting and future financial decision-making. FDs also serve as a valuable option for individuals who prefer a disciplined approach to savings, as the locked-in nature of the deposit discourages impulsive spending.

The ease of application and minimal documentation requirements make FDs accessible to a wide range of investors, contributing to their popularity as a straightforward and hassle-free investment choice. In summary, Fixed Deposits provide a combination of stability, predictability, and accessibility, making them a favored investment option for those seeking a reliable and conservative avenue for wealth preservation and growth.

Low Cibil Score Loan Apps 2024: कम सिबिल पर लोन आज सोचा, अभी मिला, न लगेगा कोई कागज न इनकम प्रूफ

Top 10 Economically Stable Countries in 2024 by GDP Biggest Economies 2024