LIC Jeevan Shanti Plan : India’s insurance giant Life Insurance Corporation (LIC) has many plans for every age group. Be it a monthly investment or a monthly pension plan, LIC has many options. If you want to make a granular investment and earn a monthly or annual pension, you can go for LIC’s Jeevan Shanti Plan. This is an annuity plan which has an option to purchase a fixed annuity and can be purchased by making just one lump sum payment. This LIC Jeevan Shanti Plan has fixed payouts of fixed amounts which continue for the entire life of the investor. Getting a tabulated annuity plan is a wise move for those who want to ensure that when they retire, they have a regular flow of money. This is a way you can build a fund for the future and then have a secure income when you need it most.

The main reason to get this LIC Jeevan Shanti Plan is that it ensures that there is a dependent income when you retire. By adding money to the LIC Jeevan Shanti Plan while you work, you build a healthy corpus, which then results in regular payments and helps support your lifestyle when you stop working. These plans also allow you to let your money grow annually without paying annual tax on the profits you win, such as dividends or interest. This tax-deductible growth can give your savings a rapid boost over time. Unlike some pension accounts, deferred annuity plans generally have no contribution limits, allowing individuals to invest more money toward a pension when needed.

Features of LIC Jeevan Shanti Plan

Given below are the key features of LIC Jeevan Shanti Plan:-

- A policy holder can avail the death benefit under both options.

- He or she can get installment benefits for the amount payable on the death over the chosen period of five years or ten years or 15 years.

- In addition, a policyholder may surrender the insurance policy as per their convenience over the policy tenure. Having said that, the surrender price paid will be higher than the special value or guaranteed surrender value.

- He or she can also get loan facility after three months of date of policy issue or after the expiry of free look up period.

- There is no need of medical exam.

What is the Age Limit for the LIC Jeevan Shanti Plan?

The age limit for LIC policy is 30 to 79 years. There is no risk cover, yet its benefits have attracted considerable attention. Two options have been provided by the company to buy this LIC Jeevan Shanti Plan.

The first option is pure delusion for single life and the second is pure delusion for paired life. This means you can invest in a plan for yourself or choose a joint plan with someone else if that’s more what you like.

Eligibility Criteria for LIC Jeevan Shanti Plan

The eligibility criteria that must be met to purchase the LIC Jeevan Shanti insurance policy is mentioned in the table below:-

| Maximum Purchase Price | No limit |

| Minimum Purchase Price | Monthly: Rs.1,000 Quarterly: Rs.3,000 Half-Yearly: Rs.6,000 Yearly: Rs.12,000 |

| Minimum Annuity | No limit |

| Deferment Period – Maximum | 12 years (depends on the maximum vesting age) |

| Deferment Period – Minimum | 1 year |

| Vesting Age – Maximum | 80 years (at the time of last birthday) |

| Vesting Age – Minimum | 31 years (at the time of last birthday) |

| Age of Entry – Maximum | 79 years (at the time of last birthday) |

| Age of Entry – Minimum | 30 years (at the time of last birthday) |

How you can get 1 lakh rupees Jeevan Shanti pension?

LIC’s New Jeevan Shanti Plan is an annuity plan in which you can invest and secure a fixed pension limit. For example, if a 55-year-old invests Rs 11 lakh in this scheme and holds it for five years, he can expect an annual inflow of Rs 1,01,880. The pension amount received every six months will be Rs 49,911, and every month, it will be Rs 8,149.

Many fixed annuity plans come with a death benefit that is regularly determined to assure the caregiver that his or her victim will be paid if not during the policyholder’s accumulation phase. This facility can provide financial security for loved ones.

TAX Refund: Check Your IRS Tax Return Status, Refund Timetable & Date @irs.gov

PM MUDRA Loan 2023: 50000 से 10 लाख का लोन घर बैठे, बिना झंझट लोन फटाफट करें अप्लाई

Insurance policy

An insurance policy is an agreement between an individual or organization (the policyholder) and an insurance company. Instead, in exchange for regular premium payments, insurance companies provide financial protection against specific risks or losses. Policy details include terms and conditions, coverage limits, and premium amount.

It acts as a legal document setting out the obligations of both parties. When a covered event, such as an accident, illness, or property damage, occurs, the insurance company is required to provide financial assistance or special benefits. LIC Insurance policies provide a means for individuals and businesses to reduce financial risks and achieve peace of mind.

Life Insurance Corporation of India (LIC)

Life Insurance Corporation of India (LIC) was established on 1 September, 1956. LIC is recognized by several methods. LIC is a deal that ensures a specified person that a payment will be made on a specified condition, which is dedicated to the agreement. LIC offers fixed terms like protection of an individual, compensation for theft of goods, reimbursement for any purpose, tax relief, and capital on need.

Life insurance provides redefined monetary support for any mishap. The major areas of providing life insurance to an individual are protection, protection against theft, recovery, tax recourse, and monetary support when needed.

In savings, life insurance guarantees complete protection to the savings against the risk of death. In case of death, life insurance guarantees payment of the entire sum assured while balance savings return only the amount that has been saved.

Bharti AXA Life Wealth Pro: बचत, बीमा और रिटर्न का Guaranteed फायदा Life Cover With Tax Benefits

50,000 से 1 लाख़ महीने हर मिलेंगे SBI से, जानें इस स्कीम के बारे में

Benefits of the loan

By taking out an insurance policy, you can easily ensure your future financial security in case something goes wrong.

- It protects against static and lethal incidents, such as sales, technicians, natural calamities, and others.

- By paying regular premiums, the permanent holder’s risk is transferred to the insurance company, which charges the cost of injury, treatment, or damage

- It helps individuals and families maintain their financial condition in challenging times. Additionally, insurance promotes financial planning and responsible risk management while encouraging savings and investment.

- It supports economic growth by ensuring entrepreneurship and business sustainability.

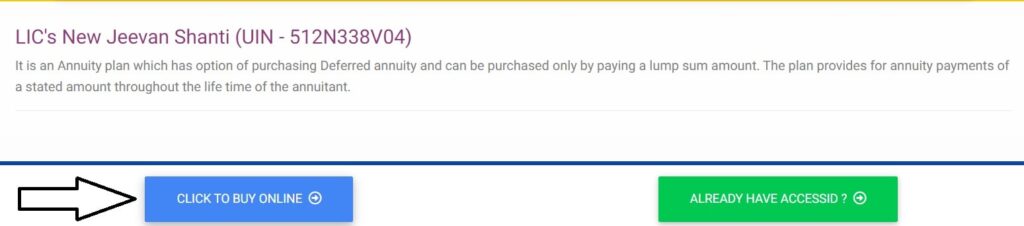

How to Purchase LIC Jeevan Shanti Plan Online ?

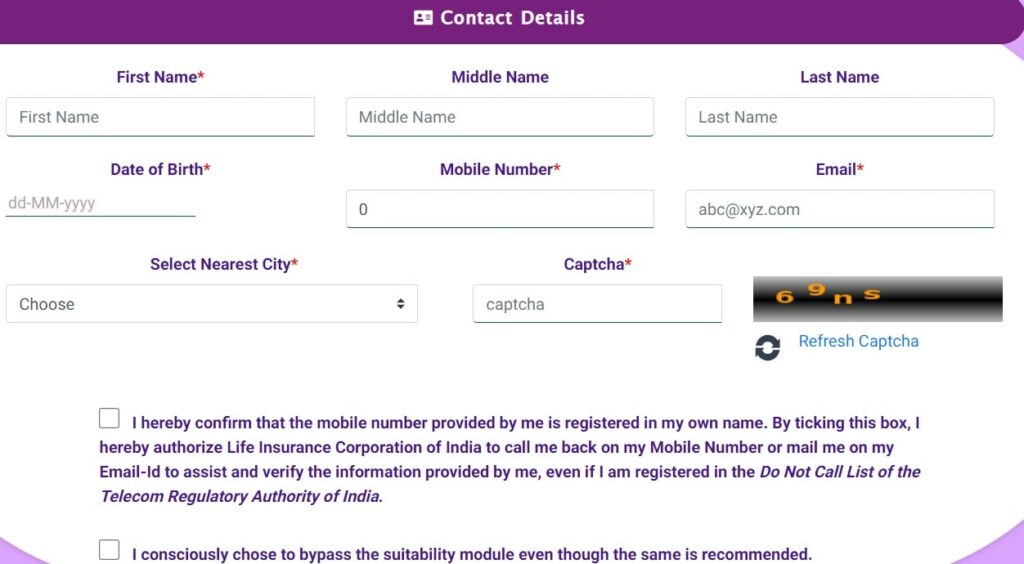

Below are the steps to purchase LIC’s New Jeevan Shanti Plan Online :-

- First of all, you need to visit the official website of LIC i.e..https://licindia.in/.

- Under the ‘Buy Policy Online’ section, scroll down and click on ‘LIC Jeevan Shanti’ option.

- Tap on ‘Buy Online’ button.

- Click on ‘Click to Buy Online’ and provide all your details. Click on ‘Calculate Premium’.

- You will receive a One Time Password(OTP) on your registered mobile number.

- Enter the OTP on the necessary section.

- Then enter all your personal details.

- Check the premium amount and click on ‘Confirm and Proceed’.

- Finally, make the premium payment via your preferred mode of payment.

How to Purchase LIC Jeevan Shanti Plan Offline ?

The customer also has an option to visit the nearest LIC branch or call the lic agent to purchase lic jeevan shanti plan offline. Before investing in a plan, ensure that the scheme meets your long-term goals and covers all your needs while you plan a life of leisure post-retirement.

Exclusions under LIC Jeevan Shanti Plan

Suicide: In case the last survivor/annuitant of the joint life annuity commits suicide within 12 months from the date the policy commences, LIC will void the policy.

Under such cases, the Surender Value or 80% of the premium that is paid, whichever is higher, will be payable. No other claims will be entertained by LIC.

What are the different methods of annuity payment in LIC’s New Jeevan Shanti Insurance?

The policyholders can make annuity payments through monthly, quarterly, half annually, and annually.

Can an individual apply for LIC New Jeevan Shanti Policy Offline?

Yes, you can apply for LIC’s New Jeevan Shanti policy offline.