Social Security Increase 2024: Here in this article, we have given you the information about the social security amount increase. If you also want to know whether the social security amount is increased or not, or the other information about the SSA, then we highly recommend you read this complete article.

Social Security benefits are administered by the SSA. These benefits include Supplemental Security Income, Medicare, Retirement, Disability and Survivors. These important benefits help people when they retire, are unable to work due to disability, lose a spouse, or have difficulty meeting employment-related everyday expenses, such as food, clothing, etc. Benefits provided by the Social Security Administration increase according to COLA adjustments. Benefits are regularly adjusted to meet increases in the cost of living. Social Security and SSI beneficiaries will receive a total increase of 3.2% in 2024.

Does the government increase the social security amount?

According to the Social Security agency, Social Security and SSI benefits will be increased for 71 million citizens in 2024. The enhanced Social Security benefits were announced on October 12, 2023. This means that Social Security benefits provided by the Social Security Administration will increase by an average of more than $50 per beneficiary per month. This increase will not be effective in December 2023.

When will the citizens get the benefits of this Social Security Increase 2024?

The increase in Social Security benefits will be visible starting in January 2024. According to the SSA, more than 66 million citizens who are recipients of Social Security benefits will be able to receive increased monthly payments in January 2024.

How much they can receive can be found in their “My Social Security Amount” Additionally, individuals can also view information about the COAL 2024 announcement from their “My Social Security Account” or by visiting the Social Security Administration’s official web portal.

Therefore, those who are currently receiving benefits will see a significant increase in their monthly payment amount. The increased amount will help citizens meet their fundamental needs. This could do many things of great value to alleviate the collective economic hardships of millions of citizens. The maximum amount of income subject to Social Security tax will also increase in 2024. This limit will be adjusted to $168,600 in 2024. Previously (in 2023), this limit was set at $160,200.

Social Security will begin notifying beneficiaries about their increased monthly benefits and other related information in December 2023. However, those who want to know how much they will receive in 2024 due to the COLA increase can always use their My Social Security account to check. information faster and more efficiently.

Rajasthan PTET Result 2024 Live Updates, Download Scorecard @ptetvmou2024.com

How SSA administration calculate COLA?

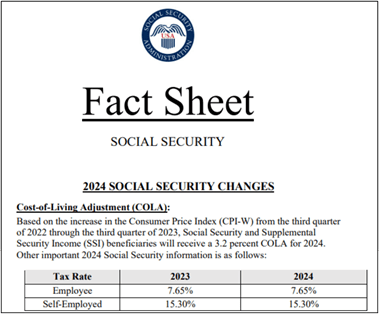

The Social Security Administration links annual increases to the Consumer Price Index (CPI-W) to determine how much they need to adjust. Information on CPI-W growth is provided by the Labor Statistics Division of the Bureau of Labor Statistics.

The COLA in July 1975 was 8%, while the COLA in January 2022 was 5.9%. The last COLA increase was in 2023, or 8.7%. A fact sheet on COLA and other adjusted benefits is available on the Social Security Administration’s official website.

Increase in COLA percentage in the past years

| Past Years | COLA percentage |

| July 1975 | 8% |

| January 1985 | 3.5% |

| January 1995 | 2.8% |

| January 2005 | 2.7% |

| January 2015 | 1.7% |

| January 2020 | 1.6% |

| January 2023 | 8.7% |

| January 2024 | 3.2% |

These are some of the issues that have arisen in the adjustments made to COLA since 1975. Adjustments for each year since 1975 are available on the SSA website.

TNPSC Group 2 Apply Online 2024 (Direct Link): Application Form, 2327 Vacancies @tnpscexams.in

How much SSA will increase the government?

All beneficiaries will get a 3.2% increase in the coming year. As a result of this review, the maximum taxable income will now be $168,600. However, there will be no limits on taxable income associated with Medicare.

Additionally, the quarter of coverage will also increase from $1,640 to $1,730 in 2024. The tax-free amount of retirement income subject to full age will be $22,320 annually in 2024. This free amount was previously $21,240 annually.

Expected SSA benefits citizens will get from January 2024

| Beneficiary | Before the increase of 3.2% | After the increase of 3.2% |

| Elder couple (both will get the benefits) | 2,939 dollars monthly | 3,033 dollars monthly |

| Workers (retired) | 1,848 dollars monthly | 1,907 dollars monthly |

| Elder Widow(er) (alone) | 1,718 dollars monthly | 1,773 dollars monthly |

| Disabled Workers (disabled) | 1,489 dollars monthly | 1,537 dollars monthly |

| Spouse, 1 or more children, and Disabled Workers | 2,636 dollars monthly | 2,720 dollars monthly |

| Widowed Mother withtwoChildren | 3,540 dollars monthly | 3,653 dollars monthly |

The tax-free amount of retirement income in the year you attain full retirement age will be Rs 59,520 per annum. This tax-free amount was earlier fixed at Rs 56,520 per year. We hope this article is beneficial for you, visit our website for more such kind of content.

ISTSE Olympiad Scholarship 2024 Registration, Online Exam, Awards and Benefits

Reward of Rs 1 lakh each to 10th and 12th toppers; When and how will the prize be given?