Stimulus Check March 2024 : Stimulus checks, also known as Economic Impact Payments (EIPs), have been a vital component of government efforts to provide financial assistance to individuals and families during times of economic uncertainty. The year 2024 brings a new round of stimulus checks, and understanding the eligibility criteria and how to check the status of your Economic Impact Payment is crucial for those who may be eligible.

In this article, we will discuss about the Stimulus Check March 2024 including eligibility criteria for the stimulus check and guide checking the status of your payment. So stay connected with us and read the whole article “Stimulus Check March 2024” till the end.

Stimulus Check March 2024

Stimulus checks are a form of direct financial assistance provided by the government to help individuals and families facing financial hardship. Stimulus Check March 2024 are typically a part of broader economic relief packages designed to stimulate the economy during challenging times, such as the COVID-19 pandemic. The eligibility criteria and the amount of the stimulus check can vary from one round to another, depending on the specific circumstances that trigger the need for economic support.

The Stimulus Check March 2024 is part of the American Rescue Plan that was started at the time of the COVID-19 Pandemic. The purpose was to provide financial support to lower-income-earning individuals. Millions of people have received the benefits from the sum. But in some states, the requirement for money touches sky as the limit.

Stimulus Check March 2024 : An Overview

| Post Name | Stimulus Check March 2024 |

| Year | 2024 |

| Month | March |

| Organization | US Federal Government |

| Department | Provincial Government |

| Regulating Authority | Internal Revenue Service |

| Objective | To boost the US Economy |

| Payment Date | March 21st, 2024 |

| Payment Amount | $500 to $2000 |

| Payment mode | Direct deposits |

| Website | irs.gov |

Stimulus Check March 2024 Eligibility Criteria

The Stimulus Check March 2024 Eligibility Criteria are based on several key factors, including income, tax filing status, and the number of dependents. It’s essential to be aware of these criteria to determine if you qualify for the payment:

- Income Thresholds : The primary determinant of stimulus check eligibility is your adjusted gross income (AGI). For the 2024 stimulus check, the following income thresholds apply:

- Single Filers : Individuals with an AGI of up to $75,000 are eligible for the full payment.

- Head of Household : Those with an AGI of up to $112,500 are eligible for the full payment.

- Married Filing Jointly : Couples with a combined AGI of up to $150,000 are eligible for the full payment. The payment amount gradually decreases as income exceeds these thresholds. For single filers, the payment decreases by $5 for every $100 over the threshold. For head-of-household filers, the reduction begins after $112,500, and for married couples, it begins after $150,000.

- Tax Filing Status : You must have filed your federal income tax return for the year in which the stimulus check is being issued. Tax filing status can affect your eligibility and the amount of your payment.

- Dependents : The number of dependents you claim on your tax return can also impact your eligibility. For the 2024 stimulus check, eligible individuals will receive an additional payment for each dependent claimed on their tax return. This includes children under the age of 18, college students, and elderly dependents.

- Social Security Numbers : You, your spouse (if applicable), and any dependents must have valid Social Security numbers to qualify for the stimulus check.

- Immigration Status : Eligibility criteria may vary for non-U.S. citizens. Generally, individuals with valid Social Security numbers who meet other eligibility requirements can qualify.

- [4th EIPS] Stimulus Check 2023

- How to Apply for Student Loan Forgiveness

- SRD R350 Payment SASSA Status

- Minnesota Property Tax Refund Programs 2023

- Malaysia Pension Payment Dates

- IRM Energy IPO 2023

- Protean e-Gov Technologies IPO

- I Bonds vs. Treasury Bills

How to check Stimulus Check March 2024 Payment ?

- You can check the progression of your payment on the main page of the IRS website, @irs.gov while using its official URL.

- As soon as you get to the IRS website’s main page, you have to log in using your login information.

- You will then be directed to a new page in your browser, which is your IRS Dashboard.

- After entering your tax ID or social security number, click the submit button to proceeding.

- Finding the URL to verify IRS Tax Fourth Stimulus Check payment status is now necessary.

- This is how you may find out if your Stimulus Check March 2024 Payment.

Stimulus Check March 2024 Payment Status

If you believe you meet the eligibility criteria for the Stimulus Check March 2024, you can check the status of your Economic Impact Payment to ensure it’s on the way.

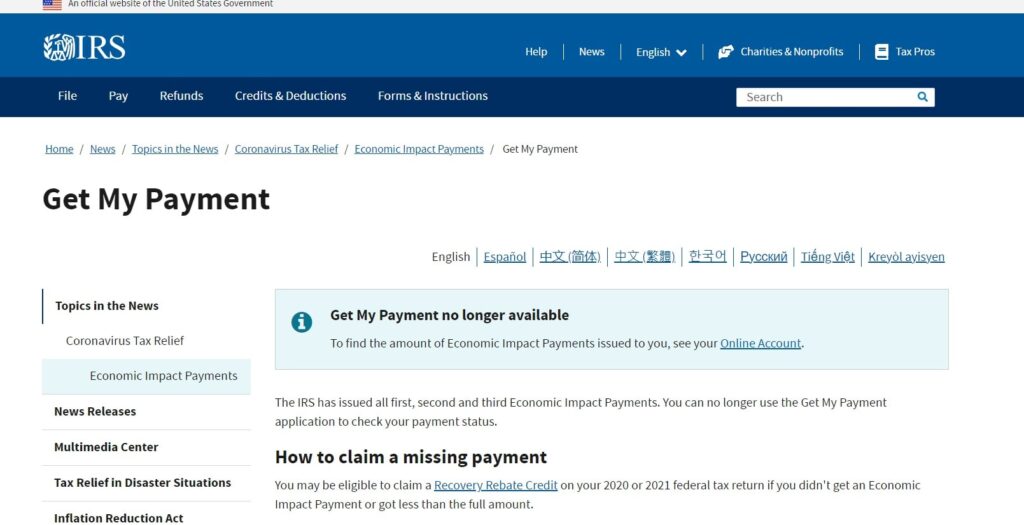

1. IRS Get My Payment Tool :

The IRS provides an online tool called “Get My Payment” on its website, which allows you to track the status of your stimulus payment.

- Visit the IRS Get My Payment tool at https://www.irs.gov/coronavirus/get-my-payment.

- Provide your Social Security number or Individual Taxpayer Identification Number (ITIN), date of birth, street address, and ZIP code.

- Click “Continue” to access the status of your payment.

- The tool will display information about your stimulus payment, including the payment date and method (direct deposit or mailed check). It will also notify you if any issues may delay your payment.

2. IRS2Go App:

- The IRS also offers a mobile app called IRS2Go, which provides access to the “Get My Payment” tool. You can download the app on your mobile device from app stores such as Apple’s App Store or Google Play.

3. Contact the IRS:

- If you encounter issues with the online tools or prefer to speak with an IRS representative directly, you can contact the IRS Economic Impact Payment Information Center at 1-800-919-9835. Be prepared to provide your Social Security number, date of birth, and other relevant information for verification.

4. Check Your Mail:

- If you are receiving a paper check, be sure to check your mail regularly. The physical check will be sent to the address the IRS has on file. You can also set up a forwarding service with the postal service to ensure you receive your check at your current address.

5. Beware of Scams:

- Be cautious of scammers who may attempt to impersonate the IRS. The IRS will not contact you via email, phone calls, or text messages regarding your stimulus payment. Use official IRS resources to check your payment status.

6. Keep Records:

It’s advisable to keep records of your stimulus payments, including the payment amount, date, and method of receipt, for tax and financial planning purposes.

Impact of Changes in Tax Laws

The eligibility criteria and payment amounts for stimulus checks can be influenced by changes in tax laws and economic conditions. For this reason, it’s essential to stay informed about any updates or adjustments to stimulus payment programs. Tax laws and regulations are subject to change, and government decisions can affect the availability and distribution of stimulus payments.

Stimulus Check March 2024 EIPS Payment DATE

Stimulus checks, or Economic Impact Payments, play a significant role in providing financial relief to individuals and families during periods of economic uncertainty. The eligibility criteria for these payments, such as income thresholds and tax filing status, are crucial factors in determining who qualifies.

It’s important to check the status of your Economic Impact Payment to ensure it reaches you on time. Staying informed about changes in tax laws and regulations is also essential, as these factors can influence the availability and distribution of stimulus payments.

Stimulus Check March 2024 Amount

| City | Amount |

| Alabama | $150 to $300 |

| New York | $500 to $1000 |

| Virginia | $200 to $400 |

| Florida | $250 |

| Georgia | $450 |