Canada Training Credit 2024 : The Canada Training Credit 2024 (CTC) is a refundable tax credit available to help Canadians cover the cost of eligible training fees. If you are also not aware of Canada Training Credit 2024, then this article is for you. Here in this article, we will give you a brief information about the Canada Training Credit 2024. In Canada, training credits are refundable tax credit that helps an eligible individual fund their training fees in a specified amount. The individual can claim his CTC after completing his income tax return. This training credit shows you information about your assessment and revaluation. If you want to know more essential information about the Canada Training Credit 2024, then read this complete article, here we have provided all the important information about the Canada Training Credit 2024 (CTC). Here you will get to know about the limits of CTC and many more.

The Canada Training Credit 2024 is an education credit for Canadians toward the cost of education fees. These credits are individually refundable tax credits that individuals can claim towards their education fees or other courses that the individual may pursue during a year. In CTC, individuals are allowed to claim 50% of the education or other course fees paid by them to an educational institution. In this credit, the individual can claim only his one year’s educational or training fees. The individual can claim those credits subject to tax year limitations.

Canada Training Credit 2024

The tax courtesy credit is for permanent Canadian residents. This is a newly availed tax courtesy credit that started in 2019. Individuals can claim these credits between the ages of 26 to 65 years. Beginning in 2019, individuals can claim 50% of their education. Starting in 2020, Canada Training Credit 2024 will be available at your discretion for your training credits. In this, you get a deposit of 250 CAD per year.

CTC 2024 Eligibility

The CTC is only awarded to individuals who meet the CTC 2024 Eligibility for Canada Training Credit. It Contains :-

- Every year a person files his income tax and benefits returns.

- The CTC limit for a year is more than 0.

- Must be a year-round resident of Canada.

- Your education or other course fees are paid throughout the year to your educational institution.

- Must be above 26 years of age and up to 65 years of age.

- These are some of the eligibility criteria for which a person can avail of CTC.

Canada Training Credit 2024 Amount

The amount you can claim for CTC is any amount that is less than your Canada Training Credit Limit (CTCL) for the tax year, 50% of eligible tuition and other fees paid for a course taken in India at an eligible education institution in the year you took it, or a vocational, Fees paid to certain bodies for trade or professional examination are If the credit exceeds your tax liability, you can get a refund for the difference.

Canada GST/HST Credit Dates 2024: Credit Payment Schedule, Registration & Eligibility

Canada GST Increase 2024: Know When the New GST Rate Will Be Imposed in Canada

Canada Training Credit 2024 Limit

CTC limits are set at 5,000 Canadian dollars for one lifetime. With these credits, eligible Canadian classified individuals are allowed to claim up to 250 Canadian dollars annually, which is set by CTC authorities. Beneficiaries have to follow the limits provided by the authorities.

Starting with the launch of this Canada training credit program, eligible individuals can claim up to 750 Canadian dollars annually. Subsequently, the Canada Training Credit limit is set at 250 Canadian dollars annually.

Canada Grocery Rebate 2024: Canada Grocery Rebate Payments 2024 Date & Calculate Grocery Rebate 2024

OAS Increase 2024: OAS Pension Scheme Increase, Limits, Rates, Clawback, Contribution & More

How to claim the CTC 2024 ?

If you meet the above-mentioned CTC 2024 eligibility criteria and you want to claim your Canada training credit then you have to follow some steps. You can claim the credit only at the time of making your education tax assessment. The individual is required to follow the mentioned steps to claim their CTC 2024.

Individuals can claim their CTC with electronic filing or paper filing.

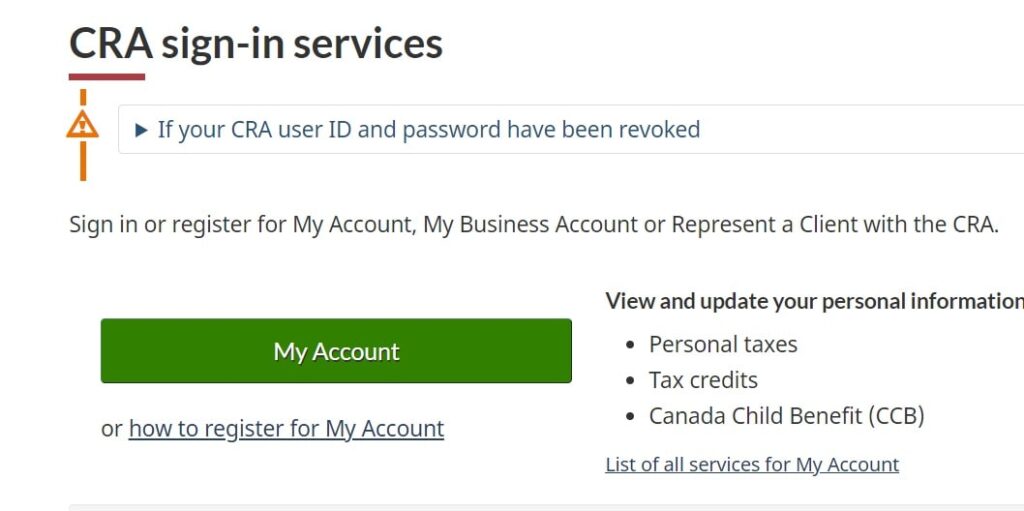

Step 1: First of all, you have to visit your CRA My Account at https://www.canada.ca/.

Step 2: After completing the first step you have to search for the training.

Step 3: After that, you will see some options related to training. Next, you have to select the Education and Learning section.

Step 4: Then, fill out your Canada Training Credit 2024 application form including reporting your tuition or any other educational fees.

Step 5: Once you complete all the above-mentioned steps, your CTC amount will be automatically calculated by CRA in your documents section.

After completing this process, click on the Submit button, and you will receive your credit amount in your CRA My Account. The individual must submit their annual income tax return to the Canada Revenue Agency and fall within the Canada Training Credit 2024 eligibility criteria to receive its benefits.

For federal education, educational, and other CTCs you can also file a paper return with income taxes using Form 5000-s11-22e. After filling out this form, you are required to submit it in e-text or large print format to CRA at their principal address.

Conclusion :-

In Canada, the Canada Training Credit 2024 is just one of many tax credits that you can take benefit of as a student. As long as you meet the requirements for this Canada Training Credit 2024, you can qualify and save some additional money on your taxes. Even if you don’t qualify, there’s still the Tuition Tax Credit, as well as many other provincial credits that can help you save on your taxes.