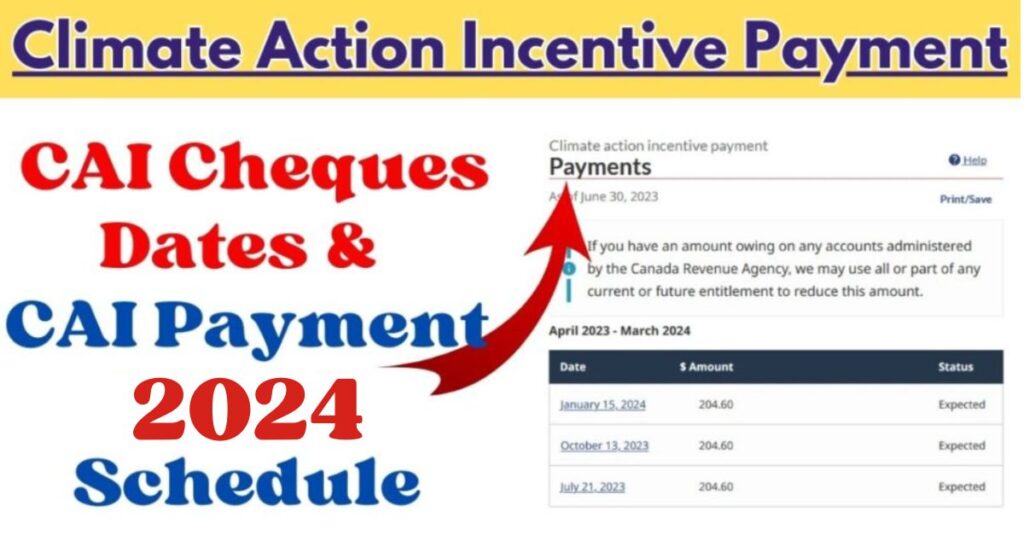

Climate Action Incentive Payment 2024: CAIP acts as a payment that helps reduce the tax burden on Canadian citizens. This incentive payment currently applies to residents of Ontario, Alberta, and Manitoba and will soon begin in New Brunswick. As Climate Action Incentive Payment 2024 is made in the fourth quarter of the year, beneficiaries look forward to the CAI Payment Schedule for climate action incentives. According to CAIP authorities, you will only make three payments in the first year. All four installments are paid in the following year. CAIP dates are April 14, July 14, October 15, 2023, and January 15, 2024. The next payment date is 15 January 2024. More information on the Climate Action Incentive Payment 2024 can be found in this article.

The problem of climate change affects all Canadians, and solving it requires reducing carbon emissions. To support these plans, the Canadian government 2019 introduced a carbon tax levied on the purchase of carbon-emitting products such as gasoline. Some Canadians are eligible for Climate Action Incentive Payments (CAIP), offered by the government to cover the cost of the federal carbon price. Small businesses and local organizations each receive 10% of the funds raised through the carbon tax. The remaining 90% is distributed directly to the public through the Community Asset Investment Program (CAIP). Some residents may receive more fuel tax than they pay.

Who qualifies for Climate Action Incentive Payment 2024?

- You may be eligible for this credit if you are a Canadian resident for income tax purposes at the beginning of the CRA pay month.

- To be eligible, you must be a resident of the applicable CAIP County on the first day of the pay month.

- You must be 19 or older for CRA to make quarterly payments.

If you are under 19, you must meet at least one of the following conditions during this time:

- Have or have had a spouse or registered partnership.

- They are older or live (or have lived) with children.

Do you have a qualified child?

You have an eligible child if the following conditions are met at the beginning of the pay month:

- Your child is under 19 years old.

- your child lives with you

- You have primary responsibility for your child’s care and education.

- Your child is registered for the Canada Child Benefit

If you are eligible for the Canada Child Benefit, one credit will be added to the CAIP calculation for each eligible child. If you have not registered your child for the Canada Child Benefit, visit Canada Child Benefit – How to Apply.

If you and your ex-spouse share custody of your children, you may be entitled to 50% of what they would have received if they lived with you full-time.

If you are new to Canada, follow the steps below to Apply for CAIP

- If you have children, then Complete and sign Form RC66, Canada Child Benefit Claim, to claim full child and family benefits, including GST/HST deductions. You must also record your citizenship and residency information on your income statement by completing RC66SCH, Canadian Status, and Canada Child Benefit Income Information.

- If you don’t have children: Complete and sign RC151, Application for Payment of GST/HST Credit, and Climate Action Incentives for Canadian Residents.

- Send the completed form to the Tax Centre.

SBI Money Double Scheme: अब स्कीम में डबल होगा पैसा- 1 लाख का 2 लाख, जानें- पूरी जानकारी

Climate Action Incentive Payment 2024

| Article Name | Climate Action Incentive Payment Date 2024 |

| Authority | Canada Revenue Agency |

| CAIP Aim | To release the Carbon Tax Burden |

| Payment Installments | 4 |

| CAIP Payment Type | Tax-free financial aid |

| CAIP Dates | 15th April, 15th July, 15th October 2023, and 15th January 2024. |

How to apply for CAI?

This is the most asked and searched question about CAIP 2024 today. So, to end your confusion, we would like to inform you that you do not need to apply separately for climate action incentive payments. When you file your income tax and benefits return, the Canada Revenue Agency (CRA) will check your eligibility and send you a payment if you’re eligible. All you have to do is keep paying your taxes each year to see if you qualify. If you are registered for direct deposit under the Tax Refund Scheme, your CAIP payment will also be sent to your registered bank account. So the process for this tax-free cash grant was very simple.

CAIP Payments: How much you will get?

The amount you receive depends on your marital status and where you live. CAIP payments are universal, meaning benefits are not reduced based on a household‘s adjusted net income.

| Particulars | Newfoundland and Labrador | Nova Scotia | Prince Edward Island | New Brunswick |

| Individual | $164 | $124 | $120 | $92 |

| Spouse | $82 | $62 | $60 | $46 |

| Per child under 19 years | $41 | $31 | $30 | $23 |

| First child in single parent family | $82 | $62 | $60 | $46 |