Best NPS Fund Managers 2024: National Pension Scheme- NPS is a government-sponsored pension scheme individuals can invest for their future savings. Subscribers who are investing in NPS are provided a special benefit by the Pension Fund Regulatory and Development Authority- PFRDA as they can now select a maximum of 3 fund managers in NPS. However other pension holders were already getting the facility of selecting multiple fund managers while National pension scheme subscribers were allowed to select only one fund manager. So, if you are also investing in the National pension scheme then you should check the latest circular of PFRDA for the subscribers of NPS in this article. We will also discuss with you the select Best NPS Fund Managers procedure and the Best NPS Fund Managers eligibility in NPS according to the NPS latest circular 2024.

NPS Subscribers can select 3 fund managers (Choose Best NPS Fund Managers)

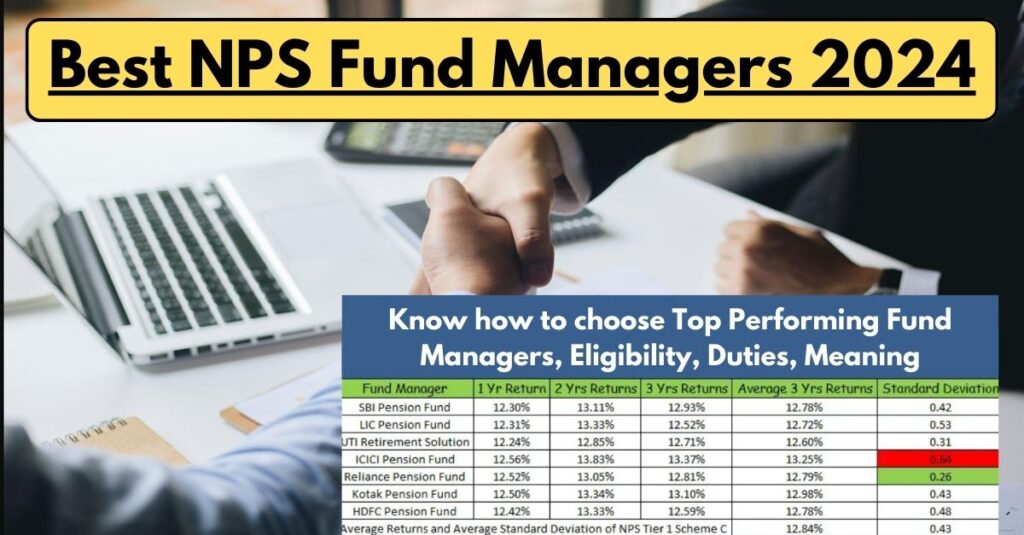

The fund manager is a financial professional responsible for managing the investments of NPS subscribers. They are selected by the Pension Fund Regulatory and Development Authority (PFRDA) based on their experience, expertise, and financial track record. The PFRDA has recently expanded the options for NPS subscribers in the ‘All Citizen Model’ and ‘Corporate Model’ categories. These subscribers can now choose preferred fund managers for equity, corporate debt, and gilts. This means that subscribers can choose different PFMs (Best NPS Fund Managers 2024) for different asset classes.

Eligibility to select Best NPS Fund Managers 2024

Along with the circular of PFRDA, the authority has also provided guidelines for the national pension scheme subscribers to select the Best NPS Fund Managers.

- Existing NPS subscribers can choose up to three different pension funds (PF) for their investments, except for Alternative Asset Class (Scheme A)

- New NPS subscribers will have to wait three months after their registration to start using this multiple PF selection option

- This option is only available for subscribers who have chosen the Active Choice (asset allocation) mode

According to the NPS Fund Managers eligibility designed by the PFRDA, only those subscribers who are lying in tier 1 of the Citizen model and corporate model and tier 2 of all Subscribers will get the benefit of this circular.

Online Payment Fraud Cases: Tips for Detecting Online Fraud, Beware of these types of online frauds

National Pension Scheme (NPS Scheme 2024)

The National Pension System (NPS) is a voluntary retirement savings scheme in India that aims to provide a regular income to members upon retirement. It is a defined contribution scheme, which means that the amount of pension received will depend on the contributions made and the investment returns earned over the years. NPS offers a range of investment options across various asset classes, including equity, corporate debt, government securities, and alternative investments. This diversification helps to mitigate risk and achieve long-term growth potential.

Key to Select NPS Fund Managers

Now National pension scheme subscribers have got a new opportunity to select a maximum of 3 fund managers for different assets. While selecting a new fund manager you should remember the following key points that will help you to provide the maximum benefits of the national pension scheme after retirement:

The previous record of the fund manager

You can try the previous record of the fund manager while checking their facilities and commitment. If they are not completing the agreement, then you can check other fund manager accordingly and track their records too. He will give you a better sense of the manager’s consistency and ability to outperform the market over the long term.

UPI Reverse Payment 2024: How can you reverse the UPI payment in case you sent the money by mistake?

Bandhan Bank Personal Loan of Rs 50,000 to 5 Lakh at 0% to 0.5%- Instant Personal loan

Investment philosophy of fund manager

A national pension scheme is a long-term Investment Program so you should check the investment policy of the fund manager which will be beneficial for you and the time of getting the investment back in your pension. Different fund managers have different investment philosophies, such as growth, value, or income. Choose a manager whose philosophy aligns with your own risk tolerance and investment goals. For example, if you are a risk-averse investor, you may want to choose a manager who focuses on value investing.